Page 203 - Plant design and economics for chemical engineers

P. 203

COST ESTIMATION 177

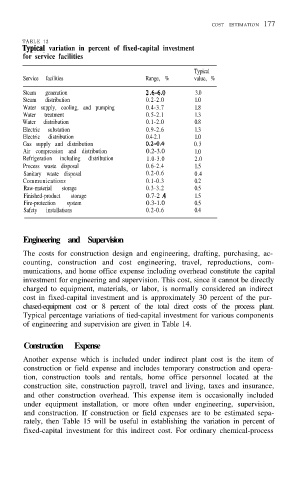

TABLE 13

Q-pica1 variation in percent of fixed-capital investment

for service facilities

Typical

Service facilities Range, % value, %

Steam generation 2.6-6.0 3.0

Steam distribution 0.2-2.0 1.0

Water supply, cooling, and pumping 0.4-3.7 1.8

Water treatment 0.5-2.1 1.3

Water distribution 0.1-2.0 0.8

Electric substation 0.9-2.6 1.3

Electric distribution 0.4-2.1 1.0

Gas supply and distribution 0.2-0.4 0.3

Air compression and distribution 0.2-3.0 1.0

Refrigeration including distribution 1.0-3.0 2.0

Process waste disposal 0.6-2.4 1.5

Sanitary waste disposal 0.2-0.6 0.4

Communications 0.1-0.3 0.2

Raw-material storage 0.3-3.2 0.5

Finished-product storage 0.7-2 .4 1.5

Fire-protection system 0.3-1.0 0.5

Safety installations 0.2-0.6 0.4

Engineering and Supervision

The costs for construction design and engineering, drafting, purchasing, ac-

counting, construction and cost engineering, travel, reproductions, com-

munications, and home office expense including overhead constitute the capital

investment for engineering and supervision. This cost, since it cannot be directly

charged to equipment, materials, or labor, is normally considered an indirect

cost in fixed-capital investment and is approximately 30 percent of the pur-

chased-equipment cost or 8 percent of the total direct costs of the process plant.

Typical percentage variations of tied-capital investment for various components

of engineering and supervision are given in Table 14.

Construction Expense

Another expense which is included under indirect plant cost is the item of

construction or field expense and includes temporary construction and opera-

tion, construction tools and rentals, home office personnel located at the

construction site, construction payroll, travel and living, taxes and insurance,

and other construction overhead. This expense item is occasionally included

under equipment installation, or more often under engineering, supervision,

and construction. If construction or field expenses are to be estimated sepa-

rately, then Table 15 will be useful in establishing the variation in percent of

fixed-capital investment for this indirect cost. For ordinary chemical-process