Page 252 - Accounting Best Practices

P. 252

c12.qxd 7/31/03 3:18 PM Page 241

241

12–16 Create a Closing Schedule

look last-minute fixed asset additions if some of the accounts payable have not

been entered. A disorganized closing can drastically delay the completion of

financial statements.

The best practice that resolves this issue is to create a closing schedule such as

the one shown in Exhibit 12.4. This schedule itemizes all tasks that must be com-

pleted during each day of the closing process. By creating such a schedule, it is

immediately obvious when all tasks must be completed so that the controller can

follow up with employees and apply extra resources to those tasks that are falling

behind the schedule. Please note that a number of activities scheduled in Exhibit

12.4 should be completed prior to the end of the reporting period, leaving much

less work to do at the end of the process. This schedule is most effective when com-

bined with a schedule of responsibilities, such as the one noted earlier in Exhibit

12.2. The two schedules can even be combined so that the name or title of the

responsible person is listed at the beginning of each activity in the closing schedule.

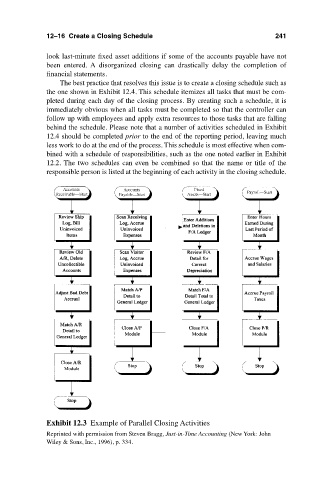

Exhibit 12.3 Example of Parallel Closing Activities

Reprinted with permission from Steven Bragg, Just-in-Time Accounting (New York: John

Wiley & Sons, Inc., 1996), p. 334.