Page 273 - Accounting Best Practices

P. 273

c13.qxd 7/31/03 3:22 PM Page 262

262

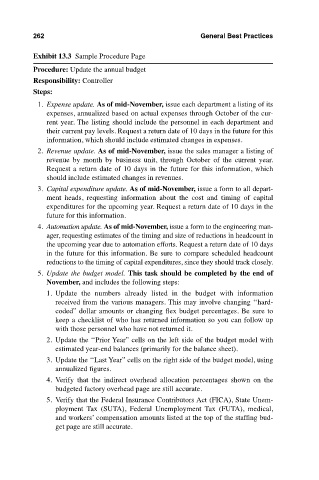

Exhibit 13.3 Sample Procedure Page General Best Practices

Procedure: Update the annual budget

Responsibility: Controller

Steps:

1. Expense update. As of mid-November, issue each department a listing of its

expenses, annualized based on actual expenses through October of the cur-

rent year. The listing should include the personnel in each department and

their current pay levels. Request a return date of 10 days in the future for this

information, which should include estimated changes in expenses.

2. Revenue update. As of mid-November, issue the sales manager a listing of

revenue by month by business unit, through October of the current year.

Request a return date of 10 days in the future for this information, which

should include estimated changes in revenues.

3. Capital expenditure update. As of mid-November, issue a form to all depart-

ment heads, requesting information about the cost and timing of capital

expenditures for the upcoming year. Request a return date of 10 days in the

future for this information.

4. Automation update. As of mid-November, issue a form to the engineering man-

ager, requesting estimates of the timing and size of reductions in headcount in

the upcoming year due to automation efforts. Request a return date of 10 days

in the future for this information. Be sure to compare scheduled headcount

reductions to the timing of capital expenditures, since they should track closely.

5. Update the budget model. This task should be completed by the end of

November, and includes the following steps:

1. Update the numbers already listed in the budget with information

received from the various managers. This may involve changing ‘‘hard-

coded” dollar amounts or changing flex budget percentages. Be sure to

keep a checklist of who has returned information so you can follow up

with those personnel who have not returned it.

2. Update the ‘‘Prior Year” cells on the left side of the budget model with

estimated year-end balances (primarily for the balance sheet).

3. Update the ‘‘Last Year” cells on the right side of the budget model, using

annualized figures.

4. Verify that the indirect overhead allocation percentages shown on the

budgeted factory overhead page are still accurate.

5. Verify that the Federal Insurance Contributors Act (FICA), State Unem-

ployment Tax (SUTA), Federal Unemployment Tax (FUTA), medical,

and workers’ compensation amounts listed at the top of the staffing bud-

get page are still accurate.