Page 278 - Analysis, Synthesis and Design of Chemical Processes, Third Edition

P. 278

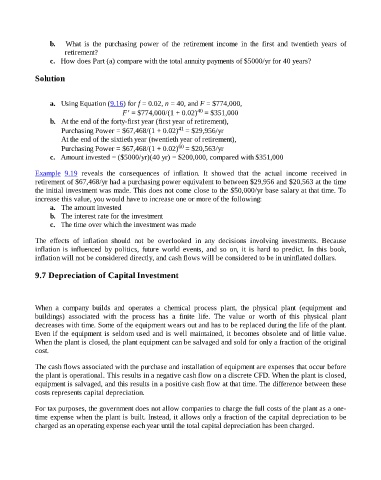

b. What is the purchasing power of the retirement income in the first and twentieth years of

retirement?

c. How does Part (a) compare with the total annuity payments of $5000/yr for 40 years?

Solution

a. Using Equation (9.16) for f = 0.02, n = 40, and F = $774,000,

40

F’ = $774,000/(1 + 0.02) = $351,000

b. At the end of the forty-first year (first year of retirement),

41

Purchasing Power = $67,468/(1 + 0.02) = $29,956/yr

At the end of the sixtieth year (twentieth year of retirement),

60

Purchasing Power = $67,468/(1 + 0.02) = $20,563/yr

c. Amount invested = ($5000/yr)(40 yr) = $200,000, compared with $351,000

Example 9.19 reveals the consequences of inflation. It showed that the actual income received in

retirement of $67,468/yr had a purchasing power equivalent to between $29,956 and $20,563 at the time

the initial investment was made. This does not come close to the $50,000/yr base salary at that time. To

increase this value, you would have to increase one or more of the following:

a. The amount invested

b. The interest rate for the investment

c. The time over which the investment was made

The effects of inflation should not be overlooked in any decisions involving investments. Because

inflation is influenced by politics, future world events, and so on, it is hard to predict. In this book,

inflation will not be considered directly, and cash flows will be considered to be in uninflated dollars.

9.7 Depreciation of Capital Investment

When a company builds and operates a chemical process plant, the physical plant (equipment and

buildings) associated with the process has a finite life. The value or worth of this physical plant

decreases with time. Some of the equipment wears out and has to be replaced during the life of the plant.

Even if the equipment is seldom used and is well maintained, it becomes obsolete and of little value.

When the plant is closed, the plant equipment can be salvaged and sold for only a fraction of the original

cost.

The cash flows associated with the purchase and installation of equipment are expenses that occur before

the plant is operational. This results in a negative cash flow on a discrete CFD. When the plant is closed,

equipment is salvaged, and this results in a positive cash flow at that time. The difference between these

costs represents capital depreciation.

For tax purposes, the government does not allow companies to charge the full costs of the plant as a one-

time expense when the plant is built. Instead, it allows only a fraction of the capital depreciation to be

charged as an operating expense each year until the total capital depreciation has been charged.