Page 151 -

P. 151

Accounting in ERP Systems

ingredients gives a total direct material cost of $537.65 for a 500-pound batch. Applying

the production overhead rate of 100 percent to this direct material cost gives a production

overhead cost equal to the direct material cost, or $537.65. As shown in the Figure 5-8,

the direct labor cost to mix the dough and bake the snack bars is $54.50. It is important to

note that the labor cost is only about 10 percent of the direct material cost, which is why

Fitter has chosen to apply production overhead costs based on direct material only.

The sum of direct materials, production overhead, and direct labor is the cost of goods

131

manufactured (COGM). Currently, Fitter uses a rate of 30 percent of the cost of goods

manufactured to estimate the sales and administrative costs. Adding the sales and

administrative costs to the COGM gives the cost of goods sold (COGS). Because the COGM

and COGS were estimated based on the BOM (recipe) from Chapter 4 that produces seven

cases of snack bars, the figures must be divided by seven to give the COGM and COGS on

a per-case basis. Figure 5-8 shows that these are $161.40 and $209.82, respectively.

The product cost analysis allows you to determine whether selling 300,000 NRG-A bars

to a new customer for a price of $0.90 per bar would earn a profit for Fitter. Given that there

are 24 bars in a box and 12 boxes in a case, the current cost for an NRG-A bar is:

$209:82=case

¼ $0:73=bar

ð24 bars=boxÞð12 boxes=caseÞ

Based on this calculation, you can see that Fitter can sell the bars at $0.90 and make a

profit of $0.17 per bar.

Exercise 5.2

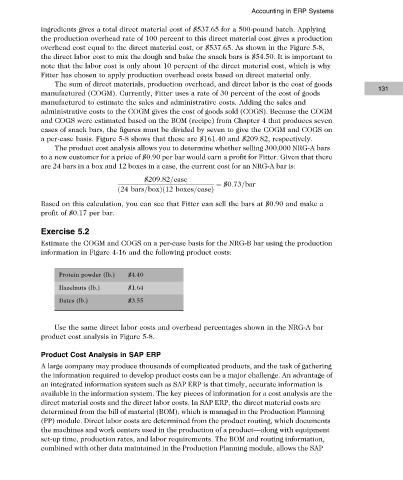

Estimate the COGM and COGS on a per-case basis for the NRG-B bar using the production

information in Figure 4-16 and the following product costs:

Protein powder (lb.) $4.40

Hazelnuts (lb.) $1.64

Dates (lb.) $3.55

Use the same direct labor costs and overhead percentages shown in the NRG-A bar

product cost analysis in Figure 5-8.

Product Cost Analysis in SAP ERP

A large company may produce thousands of complicated products, and the task of gathering

the information required to develop product costs can be a major challenge. An advantage of

an integrated information system such as SAP ERP is that timely, accurate information is

available in the information system. The key pieces of information for a cost analysis are the

direct material costs and the direct labor costs. In SAP ERP, the direct material costs are

determined from the bill of material (BOM), which is managed in the Production Planning

(PP) module. Direct labor costs are determined from the product routing, which documents

the machines and work centers used in the production of a product—along with equipment

set-up time, production rates, and labor requirements. The BOM and routing information,

combined with other data maintained in the Production Planning module, allows the SAP

Copyright 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s).

Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.