Page 203 - Essentials of Payroll: Management and Accounting

P. 203

ESSENTIALS of Payr oll: Management and Accounting

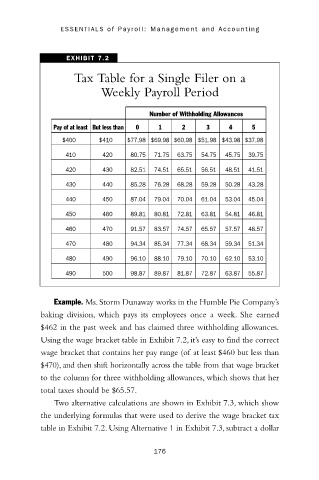

EXHIBIT 7.2

Tax Table for a Single Filer on a

Weekly Payroll Period

Number of Withholding Allowances

Pay of at least But less than 0 1 2 3 4 5

$400 $410 $77.98 $69.98 $60.98 $51.98 $43.98 $37.98

410 420 80.75 71.75 63.75 54.75 45.75 39.75

420 430 82.51 74.51 65.51 56.51 48.51 41.51

430 440 85.28 76.28 68.28 59.28 50.28 43.28

440 450 87.04 79.04 70.04 61.04 53.04 45.04

450 460 89.81 80.81 72.81 63.81 54.81 46.81

460 470 91.57 83.57 74.57 65.57 57.57 48.57

470 480 94.34 85.34 77.34 68.34 59.34 51.34

480 490 96.10 88.10 79.10 70.10 62.10 53.10

490 500 98.87 89.87 81.87 72.87 63.87 55.87

Example. Ms. Storm Dunaway works in the Humble Pie Company’s

baking division, which pays its employees once a week. She earned

$462 in the past week and has claimed three withholding allowances.

Using the wage bracket table in Exhibit 7.2, it’s easy to find the correct

wage bracket that contains her pay range (of at least $460 but less than

$470), and then shift horizontally across the table from that wage bracket

to the column for three withholding allowances, which shows that her

total taxes should be $65.57.

Two alternative calculations are shown in Exhibit 7.3, which show

the underlying formulas that were used to derive the wage bracket tax

table in Exhibit 7.2. Using Alternative 1 in Exhibit 7.3, subtract a dollar

176