Page 227 - Essentials of Payroll: Management and Accounting

P. 227

ESSENTIALS of Payr oll: Management and Accounting

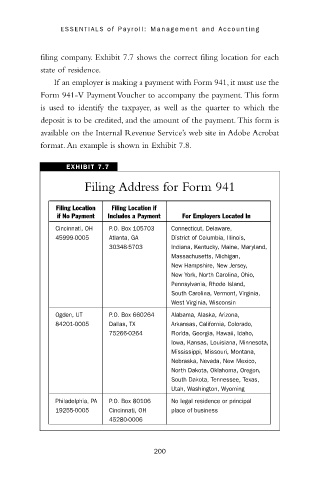

filing company. Exhibit 7.7 shows the correct filing location for each

state of residence.

If an employer is making a payment with Form 941, it must use the

Form 941-V Payment Voucher to accompany the payment. This form

is used to identify the taxpayer, as well as the quarter to which the

deposit is to be credited, and the amount of the payment. This form is

available on the Internal Revenue Service’s web site in Adobe Acrobat

format. An example is shown in Exhibit 7.8.

EXHIBIT 7.7

Filing Address for Form 941

Filing Location Filing Location if

if No Payment Includes a Payment For Employers Located In

Cincinnati, OH P.O. Box 105703 Connecticut, Delaware,

45999-0005 Atlanta, GA District of Columbia, Illinois,

30348-5703 Indiana, Kentucky, Maine, Maryland,

Massachusetts, Michigan,

New Hampshire, New Jersey,

New York, North Carolina, Ohio,

Pennsylvania, Rhode Island,

South Carolina, Vermont, Virginia,

West Virginia, Wisconsin

Ogden, UT P.O. Box 660264 Alabama, Alaska, Arizona,

84201-0005 Dallas, TX Arkansas, California, Colorado,

75266-0264 Florida, Georgia, Hawaii, Idaho,

Iowa, Kansas, Louisiana, Minnesota,

Mississippi, Missouri, Montana,

Nebraska, Nevada, New Mexico,

North Dakota, Oklahoma, Oregon,

South Dakota, Tennessee, Texas,

Utah, Washington, Wyoming

Philadelphia, PA P.O. Box 80106 No legal residence or principal

19255-0005 Cincinnati, OH place of business

45280-0006

200