Page 236 - Essentials of Payroll: Management and Accounting

P. 236

Payr oll Deductions

enforced federal laws help to track down parents who are not making

support payments; these laws also require employers to withhold vari-

ous amounts from the pay of parents in arrears to meet mandated child

support payments.

The maximum amount of an employee’s disposable earnings subject

to child support withholding is 60 percent of his or her pay,or 50 percent

if the employee is already making payments to support other children or

spouses. Both of these percentages increase by 5 percent if an employee

is 12 or more weeks in arrears in making support payments.

To calculate disposable earnings, subtract all legally mandated

deductions from an employee’s gross pay, such as federal and state

income taxes, Social Security and Medicare taxes, and any locally man-

dated disability or unemployment taxes.Voluntary deductions, such as

pension and medical insurance deductions,are not used to calculate dis-

posable earnings.

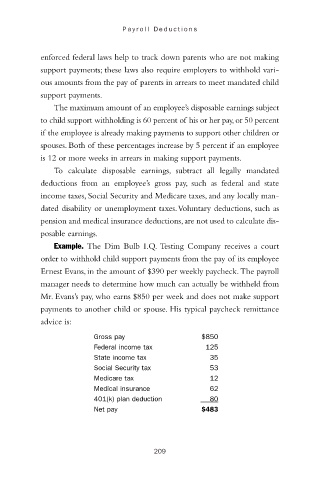

Example. The Dim Bulb I.Q. Testing Company receives a court

order to withhold child support payments from the pay of its employee

Ernest Evans, in the amount of $390 per weekly paycheck.The payroll

manager needs to determine how much can actually be withheld from

Mr. Evans’s pay, who earns $850 per week and does not make support

payments to another child or spouse. His typical paycheck remittance

advice is:

Gross pay $850

Federal income tax 125

State income tax 35

Social Security tax 53

Medicare tax 12

Medical insurance 62

401(k) plan deduction 80

Net pay $483

209