Page 245 - Essentials of Payroll: Management and Accounting

P. 245

ESSENTIALS of Payr oll: Management and Accounting

• Deductions in effect prior to the tax garnishment notice,

which can include deductions for medical, life and disability

insurance, as well as cafeteria plan deductions

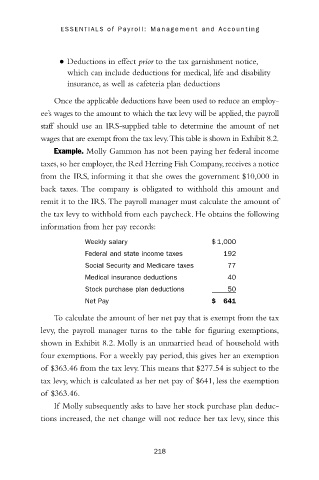

Once the applicable deductions have been used to reduce an employ-

ee’s wages to the amount to which the tax levy will be applied, the payroll

staff should use an IRS-supplied table to determine the amount of net

wages that are exempt from the tax levy.This table is shown in Exhibit 8.2.

Example. Molly Gammon has not been paying her federal income

taxes,so her employer,the Red Herring Fish Company,receives a notice

from the IRS, informing it that she owes the government $10,000 in

back taxes. The company is obligated to withhold this amount and

remit it to the IRS. The payroll manager must calculate the amount of

the tax levy to withhold from each paycheck. He obtains the following

information from her pay records:

Weekly salary $ 1,000

Federal and state income taxes 192

Social Security and Medicare taxes 77

Medical insurance deductions 40

Stock purchase plan deductions 50

Net Pay $ 641

To calculate the amount of her net pay that is exempt from the tax

levy, the payroll manager turns to the table for figuring exemptions,

shown in Exhibit 8.2. Molly is an unmarried head of household with

four exemptions. For a weekly pay period, this gives her an exemption

of $363.46 from the tax levy. This means that $277.54 is subject to the

tax levy, which is calculated as her net pay of $641, less the exemption

of $363.46.

If Molly subsequently asks to have her stock purchase plan deduc-

tions increased, the net change will not reduce her tax levy, since this

218