Page 271 - Essentials of Payroll: Management and Accounting

P. 271

ESSENTIALS of Payr oll: Management and Accounting

Depositing FUTA Taxes

When a company applies for an Employer Identification Number

(EIN), the IRS will send a Federal Tax Deposit Coupon book containing

a number of Form 8109s, which are used as an attachment that identifies

each type of deposit made to the IRS.When making a deposit, black

out the “940” box on the form. Make deposits at a local bank that is

authorized to accept federal tax deposits; do not mail deposits to the

IRS. It is also useful to list the business’s EIN, form number, and period

for which the payment is being made on the accompanying check, in

case the IRS loses the Tax Deposit Coupon.The check should be made

out to the United States Treasury.

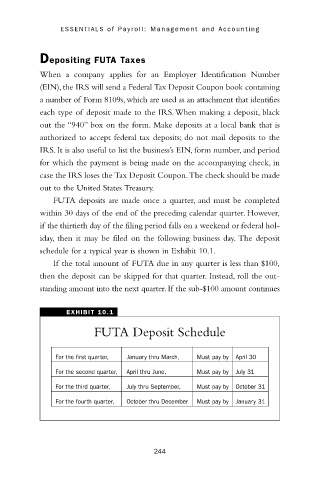

FUTA deposits are made once a quarter, and must be completed

within 30 days of the end of the preceding calendar quarter. However,

if the thirtieth day of the filing period falls on a weekend or federal hol-

iday, then it may be filed on the following business day. The deposit

schedule for a typical year is shown in Exhibit 10.1.

If the total amount of FUTA due in any quarter is less than $100,

then the deposit can be skipped for that quarter. Instead, roll the out-

standing amount into the next quarter. If the sub-$100 amount continues

EXHIBIT 10.1

FUTA Deposit Schedule

For the first quarter, January thru March, Must pay by April 30

For the second quarter, April thru June, Must pay by July 31

For the third quarter, July thru September, Must pay by October 31

For the fourth quarter, October thru December Must pay by January 31

244