Page 166 - Global Project Management Handbook

P. 166

7-16 STATE OF THE ART OF GLOBAL PROJECT MANAGEMENT

A crucial criterion for the investment decision is its financial success. The business

case analysis or the cost-benefit analysis thus are to be enclosed within the investment pro-

posal. The investment proposal is to be supplemented by a project or program proposal for

initialization of the investment. The investment proposal therefore must be differentiated

from the project proposal.

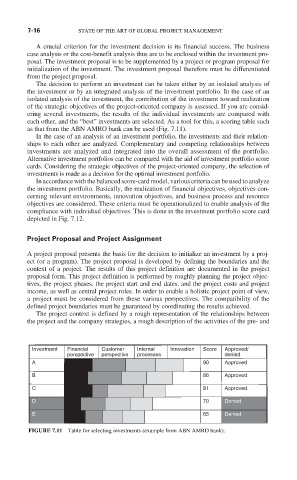

The decision to perform an investment can be taken either by an isolated analysis of

the investment or by an integrated analysis of the investment portfolio. In the case of an

isolated analysis of the investment, the contribution of the investment toward realization

of the strategic objectives of the project-oriented company is assessed. If you are consid-

ering several investments, the results of the individual investments are compared with

each other, and the “best” investments are selected. As a tool for this, a scoring table such

as that from the ABN AMRO bank can be used (Fig. 7.11).

In the case of an analysis of an investment portfolio, the investments and their relation-

ships to each other are analyzed. Complementary and competing relationships between

investments are analyzed and integrated into the overall assessment of the portfolio.

Alternative investment portfolios can be compared with the aid of investment portfolio score

cards. Considering the strategic objectives of the project-oriented company, the selection of

investments is made as a decision for the optimal investment portfolio.

In accordance with the balanced score-card model, various criteria can be used to analyze

the investment portfolio. Basically, the realization of financial objectives, objectives con-

cerning relevant environments, innovation objectives, and business process and resource

objectives are considered. These criteria must be operationalized to enable analysis of the

compliance with individual objectives. This is done in the investment portfolio score card

depicted in Fig. 7.12.

Project Proposal and Project Assignment

A project proposal presents the basis for the decision to initialize an investment by a proj-

ect (or a program). The project proposal is developed by defining the boundaries and the

context of a project. The results of this project definition are documented in the project

proposal form. This project definition is performed by roughly planning the project objec-

tives, the project phases, the project start and end dates, and the project costs and project

income, as well as central project roles. In order to enable a holistic project point of view,

a project must be considered from these various perspectives. The compatibility of the

defined project boundaries must be guaranteed by coordinating the results achieved.

The project context is defined by a rough representation of the relationships between

the project and the company strategies, a rough description of the activities of the pre- and

Investment Financial Customer Internal Innovation Score Approved/

perspective perspective processes denied

A 90 Approved

B 86 Approved

C 81 Approved

D 70 Denied

E 65 Denied

FIGURE 7.11 Table for selecting investments (example from ABN AMRO bank).