Page 55 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 55

40 PART I Background and Context

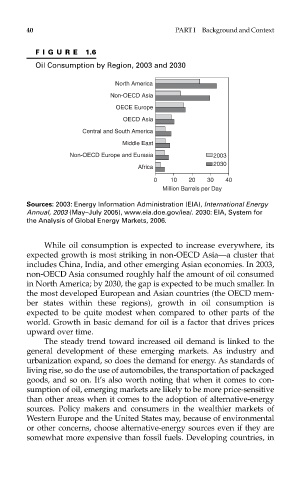

FIGURE 1.6

Oil Consumption by Region, 2003 and 2030

North America

Non-OECD Asia

OECE Europe

OECD Asia

Central and South America

Middle East

Non-OECD Europe and Eurasia 2003

2030

Africa

0 10 20 30 40

Million Barrels per Day

Sources: 2003: Energy Information Administration (EIA), International Energy

Annual, 2003 (May–July 2005), www.eia.doe.gov/iea/. 2030: EIA, System for

the Analysis of Global Energy Markets, 2006.

While oil consumption is expected to increase everywhere, its

expected growth is most striking in non-OECD Asia—a cluster that

includes China, India, and other emerging Asian economies. In 2003,

non-OECD Asia consumed roughly half the amount of oil consumed

in North America; by 2030, the gap is expected to be much smaller. In

the most developed European and Asian countries (the OECD mem-

ber states within these regions), growth in oil consumption is

expected to be quite modest when compared to other parts of the

world. Growth in basic demand for oil is a factor that drives prices

upward over time.

The steady trend toward increased oil demand is linked to the

general development of these emerging markets. As industry and

urbanization expand, so does the demand for energy. As standards of

living rise, so do the use of automobiles, the transportation of packaged

goods, and so on. It’s also worth noting that when it comes to con-

sumption of oil, emerging markets are likely to be more price-sensitive

than other areas when it comes to the adoption of alternative-energy

sources. Policy makers and consumers in the wealthier markets of

Western Europe and the United States may, because of environmental

or other concerns, choose alternative-energy sources even if they are

somewhat more expensive than fossil fuels. Developing countries, in