Page 28 - Hydrocarbon

P. 28

Petroleum Agreements and Bidding 15

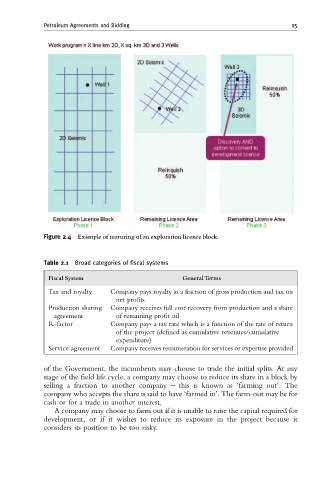

Figure 2.4 Example of maturing of an exploration licence block.

Table 2.1 Broad categories of fiscal systems

Fiscal System GeneralTerms

Tax and royalty Company pays royalty as a fraction of gross production and tax on

net profits

Production sharing Company receives full cost recovery from production and a share

agreement of remaining profit oil

R-factor Company pays a tax rate which is a function of the rate of return

of the project (defined as cumulative revenues/cumulative

expenditure)

Service agreement Company receives remuneration for services or expertise provided

of the Government, the incumbents may choose to trade the initial splits. At any

stage of the field life cycle, a company may choose to reduce its share in a block by

selling a fraction to another company – this is known as ‘farming out’. The

company who accepts the share is said to have ‘farmed in’. The farm-out may be for

cash or for a trade in another interest.

A company may choose to farm out if it is unable to raise the capital required for

development, or if it wishes to reduce its exposure in the project because it

considers its position to be too risky.