Page 131 -

P. 131

Process 113

be included in both the purchase order and the goods receipt document for

the material. If inspection is required only in unusual cases, then the stock

status can be specifi ed in the purchase order or during goods receipt. Finally,

the materials can be designated as blocked stock if they are not what the com-

pany ordered or if they are unacceptable for any reason.

In our example, GBI has received a shipment from Spy Gear. The ship-

ment includes a delivery document that states that there are 5 boxes in the

shipment, each containing 100 t-shirts. A GBI employee verifi es the contents

against the delivery document and records the receipt in the ERP system. He

does this by retrieving the purchase order identifi ed in the delivery document

and indicating that the ordered materials have been received.

Outcomes

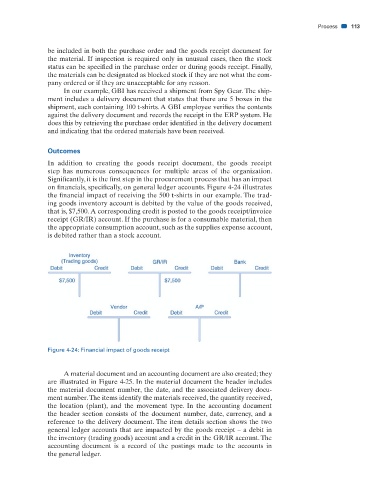

In addition to creating the goods receipt document, the goods receipt

step has numerous consequences for multiple areas of the organization.

Signifi cantly, it is the fi rst step in the procurement process that has an impact

on fi nancials, specifi cally, on general ledger accounts. Figure 4-24 illustrates

the fi nancial impact of receiving the 500 t-shirts in our example. The trad-

ing goods inventory account is debited by the value of the goods received,

that is, $7,500. A corresponding credit is posted to the goods receipt/invoice

receipt (GR/IR) account. If the purchase is for a consumable material, then

the appropriate consumption account, such as the supplies expense account,

is debited rather than a stock account.

Figure 4-24: Financial impact of goods receipt

A material document and an accounting document are also created; they

are illustrated in Figure 4-25. In the material document the header includes

the material document number, the date, and the associated delivery docu-

ment number. The items identify the materials received, the quantity received,

the location (plant), and the movement type. In the accounting document

the header section consists of the document number, date, currency, and a

reference to the delivery document. The item details section shows the two

general ledger accounts that are impacted by the goods receipt – a debit in

the inventory (trading goods) account and a credit in the GR/IR account. The

accounting document is a record of the postings made to the accounts in

the general ledger.

31/01/11 7:35 PM

CH004.indd 113 31/01/11 7:35 PM

CH004.indd 113