Page 226 - Probability Demystified

P. 226

CHAPTER 12 Actuarial Science 215

number alive at 50 95,464

P(living to age 50Þ¼ ¼ ¼ 0:963 ¼ 96:3%

number alive at 16 99,084

10. There are 78,410 males out of 100,000 alive at age 65; hence,

number alive at 65 78,410

Pðliving to age 65) ¼ ¼ ¼ 0:7841 ¼ 78:41%

100,000 100,000

Life Insurance Policies

There are many different types of life insurance policies. A straight life

insurance policy requires that you make payments for your entire life.

Then when you die, your beneficiary is paid the face value of the policy.

A beneficiary is a person designated to receive the money from an insurance

policy.

Another type of policy is a term policy. Here the insured pays a certain

premium for twenty years. If the person dies during the 20-year period, his or

her beneficiary receives the value of the policy. If the person lives beyond the

twenty-year period, he or she receives nothing. This kind of insurance has low

premiums, especially for younger people since the probability of them dying

is relative small.

Another type of life insurance policy is called an endowment policy. In this

case, if a person purchases a 20-year endowment policy and lives past 20

years, the insurance company will pay the face value of the policy to the

insured. Naturally, the premiums for this kind of policy are much higher than

those for a term policy.

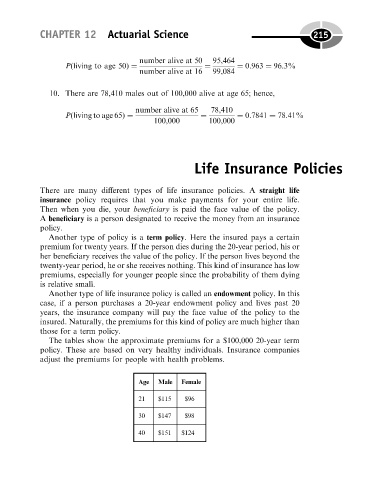

The tables show the approximate premiums for a $100,000 20-year term

policy. These are based on very healthy individuals. Insurance companies

adjust the premiums for people with health problems.

Age Male Female

21 $115 $96

30 $147 $98

40 $151 $124