Page 113 - How China Is Winning the Tech Race

P. 113

2

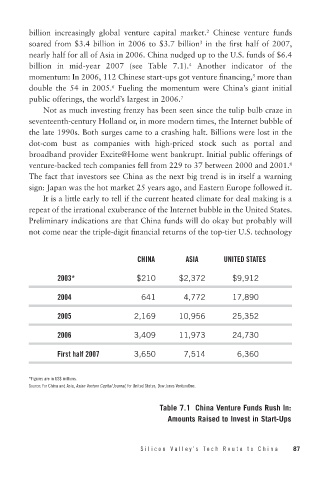

billion increasingly global venture capital market. Chinese venture funds

3

soared from $3.4 billion in 2006 to $3.7 billion in the first half of 2007,

nearly half for all of Asia in 2006. China nudged up to the U.S. funds of $6.4

billion in mid-year 2007 (see Table 7.1). 4 Another indicator of the

5

momentum: In 2006, 112 Chinese start-ups got venture financing, more than

6

double the 54 in 2005. Fueling the momentum were China’s giant initial

public offerings, the world’s largest in 2006. 7

Not as much investing frenzy has been seen since the tulip bulb craze in

seventeenth-century Holland or, in more modern times, the Internet bubble of

the late 1990s. Both surges came to a crashing halt. Billions were lost in the

dot-com bust as companies with high-priced stock such as portal and

broadband provider Excite@Home went bankrupt. Initial public offerings of

venture-backed tech companies fell from 229 to 37 between 2000 and 2001. 8

The fact that investors see China as the next big trend is in itself a warning

sign: Japan was the hot market 25 years ago, and Eastern Europe followed it.

It is a little early to tell if the current heated climate for deal making is a

repeat of the irrational exuberance of the Internet bubble in the United States.

Preliminary indications are that China funds will do okay but probably will

not come near the triple-digit financial returns of the top-tier U.S. technology

CHINA ASIA UNITED STATES

2003* $210 $2,372 $9,912

2004 641 4,772 17,890

2005 2,169 10,956 25,352

2006 3,409 11,973 24,730

First half 2007 3,650 7,514 6,360

*Figures are in US$ millions.

Source: For China and Asia, Asian Venture Capital Journal; for United States, Dow Jones VentureOne.

Table 7.1 China Venture Funds Rush In:

Amounts Raised to Invest in Start-Ups

Silicon V alley’ s T ech Route to China 87