Page 159 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 159

Chapter 4. The Stakeholders 145

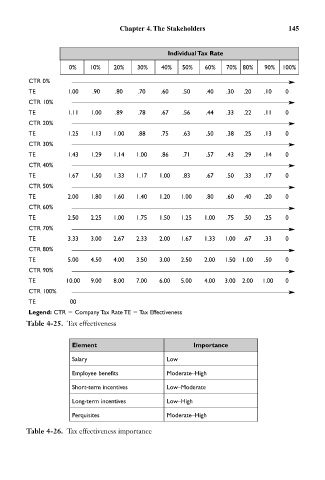

Individual Tax Rate

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

CTR 0%

TE 1.00 .90 .80 .70 .60 .50 .40 .30 .20 .10 0

CTR 10%

TE 1.11 1.00 .89 .78 .67 .56 .44 .33 .22 .11 0

CTR 20%

TE 1.25 1.13 1.00 .88 .75 .63 .50 .38 .25 .13 0

CTR 30%

TE 1.43 1.29 1.14 1.00 .86 .71 .57 .43 .29 .14 0

CTR 40%

TE 1.67 1.50 1.33 1.17 1.00 .83 .67 .50 .33 .17 0

CTR 50%

TE 2.00 1.80 1.60 1.40 1.20 1.00 .80 .60 .40 .20 0

CTR 60%

TE 2.50 2.25 1.00 1.75 1.50 1.25 1.00 .75 .50 .25 0

CTR 70%

TE 3.33 3.00 2.67 2.33 2.00 1.67 1.33 1.00 .67 .33 0

CTR 80%

TE 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 .50 0

CTR 90%

TE 10.00 9.00 8.00 7.00 6.00 5.00 4.00 3.00 2.00 1.00 0

CTR 100%

TE 00

Legend: CTR Company Tax Rate TE Tax Effectiveness

Table 4-25. Tax effectiveness

Element Importance

Salary Low

Employee benefits Moderate–High

Short-term incentives Low–Moderate

Long-term incentives Low–High

Perquisites Moderate–High

Table 4-26. Tax effectiveness importance