Page 23 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 23

Chapter 1. Executive Compensation Framework 9

Total Compensation

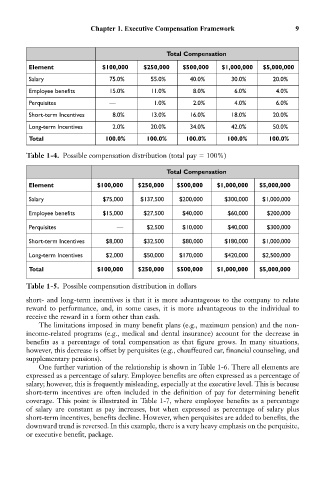

Element $100,000 $250,000 $500,000 $1,000,000 $5,000,000

Salary 75.0% 55.0% 40.0% 30.0% 20.0%

Employee benefits 15.0% 11.0% 8.0% 6.0% 4.0%

Perquisites — 1.0% 2.0% 4.0% 6.0%

Short-term Incentives 8.0% 13.0% 16.0% 18.0% 20.0%

Long-term Incentives 2.0% 20.0% 34.0% 42.0% 50.0%

Total 100.0% 100.0% 100.0% 100.0% 100.0%

Table 1-4. Possible compensation distribution (total pay 100%)

Total Compensation

Element $100,000 $250,000 $500,000 $1,000,000 $5,000,000

Salary $75,000 $137,500 $200,000 $300,000 $1,000,000

Employee benefits $15,000 $27,500 $40,000 $60,000 $200,000

Perquisites — $2,500 $10,000 $40,000 $300,000

Short-term Incentives $8,000 $32,500 $80,000 $180,000 $1,000,000

Long-term Incentives $2,000 $50,000 $170,000 $420,000 $2,500,000

Total $100,000 $250,000 $500,000 $1,000,000 $5,000,000

Table 1-5. Possible compensation distribution in dollars

short- and long-term incentives is that it is more advantageous to the company to relate

reward to performance, and, in some cases, it is more advantageous to the individual to

receive the reward in a form other than cash.

The limitations imposed in many benefit plans (e.g., maximum pension) and the non-

income-related programs (e.g., medical and dental insurance) account for the decrease in

benefits as a percentage of total compensation as that figure grows. In many situations,

however, this decrease is offset by perquisites (e.g., chauffeured car, financial counseling, and

supplementary pensions).

One further variation of the relationship is shown in Table 1-6. There all elements are

expressed as a percentage of salary. Employee benefits are often expressed as a percentage of

salary; however, this is frequently misleading, especially at the executive level. This is because

short-term incentives are often included in the definition of pay for determining benefit

coverage. This point is illustrated in Table 1-7, where employee benefits as a percentage

of salary are constant as pay increases, but when expressed as percentage of salary plus

short-term incentives, benefits decline. However, when perquisites are added to benefits, the

downward trend is reversed. In this example, there is a very heavy emphasis on the perquisite,

or executive benefit, package.