Page 240 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 240

226 The Complete Guide to Executive Compensation

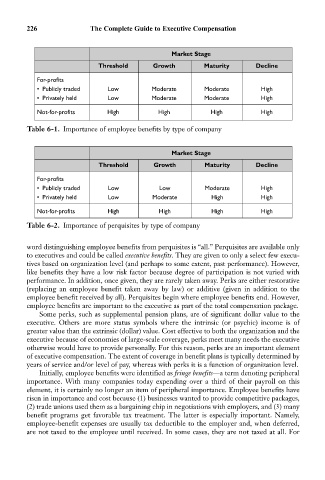

Market Stage

Threshold Growth Maturity Decline

For-profits

• Publicly traded Low Moderate Moderate High

• Privately held Low Moderate Moderate High

Not-for-profits High High High High

Table 6-1. Importance of employee benefits by type of company

Market Stage

Threshold Growth Maturity Decline

For-profits

• Publicly traded Low Low Moderate High

• Privately held Low Moderate High High

Not-for-profits High High High High

Table 6-2. Importance of perquisites by type of company

word distinguishing employee benefits from perquisites is “all.” Perquisites are available only

to executives and could be called executive benefits. They are given to only a select few execu-

tives based on organization level (and perhaps to some extent, past performance). However,

like benefits they have a low risk factor because degree of participation is not varied with

performance. In addition, once given, they are rarely taken away. Perks are either restorative

(replacing an employee benefit taken away by law) or additive (given in addition to the

employee benefit received by all). Perquisites begin where employee benefits end. However,

employee benefits are important to the executive as part of the total compensation package.

Some perks, such as supplemental pension plans, are of significant dollar value to the

executive. Others are more status symbols where the intrinsic (or psychic) income is of

greater value than the extrinsic (dollar) value. Cost effective to both the organization and the

executive because of economies of large-scale coverage, perks meet many needs the executive

otherwise would have to provide personally. For this reason, perks are an important element

of executive compensation. The extent of coverage in benefit plans is typically determined by

years of service and/or level of pay, whereas with perks it is a function of organization level.

Initially, employee benefits were identified as fringe benefits—a term denoting peripheral

importance. With many companies today expending over a third of their payroll on this

element, it is certainly no longer an item of peripheral importance. Employee benefits have

risen in importance and cost because (1) businesses wanted to provide competitive packages,

(2) trade unions used them as a bargaining chip in negotiations with employers, and (3) many

benefit programs get favorable tax treatment. The latter is especially important. Namely,

employee-benefit expenses are usually tax deductible to the employer and, when deferred,

are not taxed to the employee until received. In some cases, they are not taxed at all. For