Page 304 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 304

290 The Complete Guide to Executive Compensation

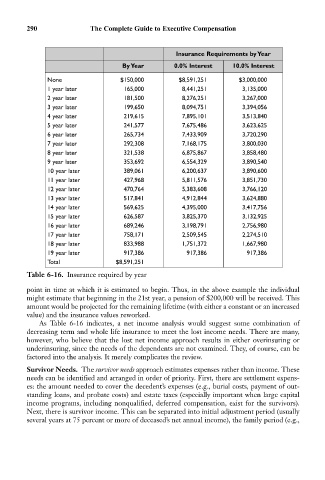

Insurance Requirements by Year

By Year 0.0% Interest 10.0% Interest

None $150,000 $8,591,251 $3,000,000

1 year later 165,000 8,441,251 3,135,000

2 year later 181,500 8,276,251 3,267,000

3 year later 199,650 8,094,751 3,394,056

4 year later 219,615 7,895,101 3,513,840

5 year later 241,577 7,675,486 3,623,625

6 year later 265,734 7,433,909 3,720,290

7 year later 292,308 7,168,175 3,800,030

8 year later 321,538 6,875,867 3,858,480

9 year later 353,692 6,554,329 3,890,540

10 year later 389,061 6,200,637 3,890,600

11 year later 427,968 5,811,576 3,851,730

12 year later 470,764 5,383,608 3,766,120

13 year later 517,841 4,912,844 3,624,880

14 year later 569,625 4,395,000 3,417,756

15 year later 626,587 3,825,370 3,132,925

16 year later 689,246 3,198,791 2,756,980

17 year later 758,171 2,509,545 2,274,510

18 year later 833,988 1,751,372 1,667,980

19 year later 917,386 917,386 917,386

Total $8,591,251

Table 6-16. Insurance required by year

point in time at which it is estimated to begin. Thus, in the above example the individual

might estimate that beginning in the 21st year, a pension of $200,000 will be received. This

amount would be projected for the remaining lifetime (with either a constant or an increased

value) and the insurance values reworked.

As Table 6-16 indicates, a net income analysis would suggest some combination of

decreasing term and whole life insurance to meet the lost income needs. There are many,

however, who believe that the lost net income approach results in either overinsuring or

underinsuring, since the needs of the dependents are not examined. They, of course, can be

factored into the analysis. It merely complicates the review.

Survivor Needs. The survivor needs approach estimates expenses rather than income. These

needs can be identified and arranged in order of priority. First, there are settlement expens-

es: the amount needed to cover the decedent’s expenses (e.g., burial costs, payment of out-

standing loans, and probate costs) and estate taxes (especially important when large capital

income programs, including nonqualified, deferred compensation, exist for the survivors).

Next, there is survivor income. This can be separated into initial adjustment period (usually

several years at 75 percent or more of deceased’s net annual income), the family period (e.g.,