Page 338 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 338

324 The Complete Guide to Executive Compensation

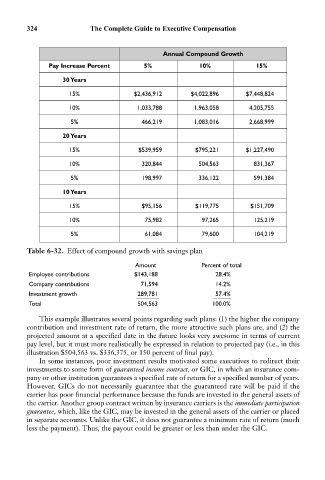

Annual Compound Growth

Pay Increase Percent 5% 10% 15%

30 Years

15% $2,436,912 $4,022,896 $7,448,824

10% 1,033,788 1,963,058 4,205,755

5% 466,219 1,083,016 2,668,999

20 Years

15% $539,959 $795,221 $1,227,490

10% 320,844 504,563 831,367

5% 198,997 336,122 591,384

10 Years

15% $95,156 $119,775 $151,709

10% 75,982 97,265 125,219

5% 61,084 79,600 104,219

Table 6-32. Effect of compound growth with savings plan

Amount Percent of total

Employee contributions $143,188 28.4%

Company contributions 71,594 14.2%

Investment growth 289,781 57.4%

Total 504,563 100.0%

This example illustrates several points regarding such plans: (1) the higher the company

contribution and investment rate of return, the more attractive such plans are, and (2) the

projected amount at a specified date in the future looks very awesome in terms of current

pay level, but it must more realistically be expressed in relation to projected pay (i.e., in this

illustration $504,563 vs. $336,375, or 150 percent of final pay).

In some instances, poor investment results motivated some executives to redirect their

investments to some form of guaranteed income contract, or GIC, in which an insurance com-

pany or other institution guarantees a specified rate of return for a specified number of years.

However, GICs do not necessarily guarantee that the guaranteed rate will be paid if the

carrier has poor financial performance because the funds are invested in the general assets of

the carrier. Another group contract written by insurance carriers is the immediate participation

guarantee, which, like the GIC, may be invested in the general assets of the carrier or placed

in separate accounts. Unlike the GIC, it does not guarantee a minimum rate of return (much

less the payment). Thus, the payout could be greater or less than under the GIC.