Page 360 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 360

346 The Complete Guide to Executive Compensation

Teams may be defined as ad hoc or long-standing as well as project versus process.

Since executives typically are not paid on the basis of teams, that definition of group is not

included in this section. However, groups that are defined vertically descending down

through the organization are included because an “executive” usually heads each one.

Short-term incentive plans range from highly individualistic rewards for individual

accomplishment to sophisticated profit-sharing plans, with emphasis on corporate, group,

and/or division performance and little variance for individual recognition. The main draw-

back of the profit-sharing model is that it will overpay the marginal performer in good years

and underpay the outstanding performer in poor years.

Furthermore, a low-salary/high-bonus mix will overpay mediocre performers in good

years and risk losing top-quality executives in poor years. Conversely, a high-salary/low-

bonus combination will reinforce mediocre performance in poor years by overpaying the

marginal performers while underpaying the outstanding performers. Therefore, the incen-

tive plan design must be consistent with the message. One cannot emphasize the importance

of individual contribution if the plan excludes any individual performance factors.

Thus, incentives are the visible reward (for successful performance) and punishment (for

less than outstanding accomplishment). Unfortunately, some companies are more interested

in form than substance; however, more and more companies are prepared to measure per-

formance and pay for the degree of accomplishment. This is more difficult with discretionary

plans than those with prescribed formulas, as will be discussed later in the chapter.

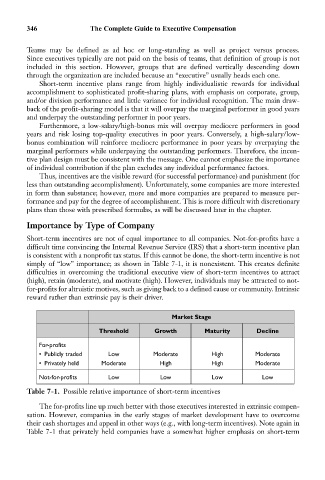

Importance by Type of Company

Short-term incentives are not of equal importance to all companies. Not-for-profits have a

difficult time convincing the Internal Revenue Service (IRS) that a short-term incentive plan

is consistent with a nonprofit tax status. If this cannot be done, the short-term incentive is not

simply of “low” importance; as shown in Table 7-1, it is nonexistent. This creates definite

difficulties in overcoming the traditional executive view of short-term incentives to attract

(high), retain (moderate), and motivate (high). However, individuals may be attracted to not-

for-profits for altruistic motives, such as giving back to a defined cause or community. Intrinsic

reward rather than extrinsic pay is their driver.

Market Stage

Threshold Growth Maturity Decline

For-profits

• Publicly traded Low Moderate High Moderate

• Privately held Moderate High High Moderate

Not-for-profits Low Low Low Low

Table 7-1. Possible relative importance of short-term incentives

The for-profits line up much better with those executives interested in extrinsic compen-

sation. However, companies in the early stages of market development have to overcome

their cash shortages and appeal in other ways (e.g., with long-term incentives). Note again in

Table 7-1 that privately held companies have a somewhat higher emphasis on short-term