Page 41 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 41

Chapter 1. Executive Compensation Framework 27

group. Stock options from the former company are typically converted on an equivalency

basis, namely, (1) no reduction in ratio of exercise price to market price, (2) the option spread

is not greater, and (3) the vesting and other option terms remain the same. This is described

more fully in Chapter 8 on long-term incentives.

A key difference between a spin-off and the earlier-described initial public offering is

that with an IPO, stock is sold to new shareholders. With a spin-off, stock is given away to

existing shareholders.

The objective of an IPO is typically to raise capital, enabling the organization to invest

in buildings, equipment, and people. However, it might also be to reverse an LBO (leveraged

buyout), taking down debt and liquefying investor holdings. A spin-off is frequently done to

sharpen the focus and direction of an organization, capitalizing on its core competencies,

and, hopefully, increasing shareholder value.

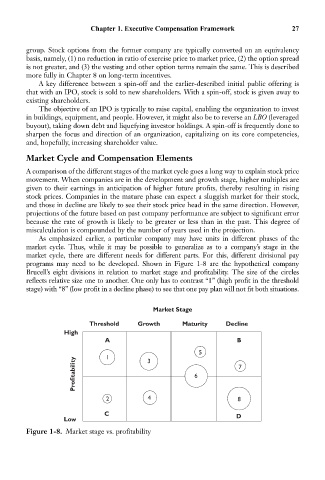

Market Cycle and Compensation Elements

A comparison of the different stages of the market cycle goes a long way to explain stock price

movement. When companies are in the development and growth stage, higher multiples are

given to their earnings in anticipation of higher future profits, thereby resulting in rising

stock prices. Companies in the mature phase can expect a sluggish market for their stock,

and those in decline are likely to see their stock price head in the same direction. However,

projections of the future based on past company performance are subject to significant error

because the rate of growth is likely to be greater or less than in the past. This degree of

miscalculation is compounded by the number of years used in the projection.

As emphasized earlier, a particular company may have units in different phases of the

market cycle. Thus, while it may be possible to generalize as to a company’s stage in the

market cycle, there are different needs for different parts. For this, different divisional pay

programs may need to be developed. Shown in Figure 1-8 are the hypothetical company

Brucell’s eight divisions in relation to market stage and profitability. The size of the circles

reflects relative size one to another. One only has to contrast “1” (high profit in the threshold

stage) with “8” (low profit in a decline phase) to see that one pay plan will not fit both situations.

Market Stage

Threshold Growth Maturity Decline

High

A B

5

1

Profitability 6 7

3

2 4 8

C

Low D

Figure 1-8. Market stage vs. profitability