Page 417 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 417

Chapter 8. Long-Term Incentives 403

Market Stage

Threshold Growth Maturity Decline

For-profits

• Publicly traded High High Moderate Low

• Privately held Moderate Moderate Moderate Low

Not-for-profits Low Low Low Low

Table 8-1. Possible relative importance of long-term incentives under varying circumstances

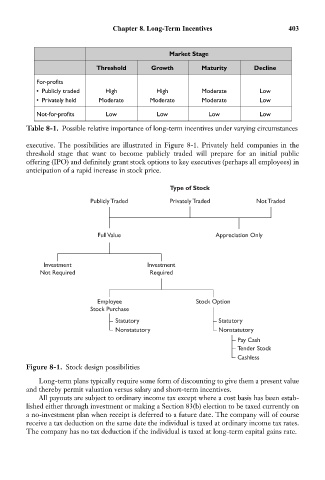

executive. The possibilities are illustrated in Figure 8-1. Privately held companies in the

threshold stage that want to become publicly traded will prepare for an initial public

offering (IPO) and definitely grant stock options to key executives (perhaps all employees) in

anticipation of a rapid increase in stock price.

Type of Stock

Publicly Traded Privately Traded Not Traded

Full Value Appreciation Only

Investment Investment

Not Required Required

Employee Stock Option

Stock Purchase

Statutory Statutory

Nonstatutory Nonstatutory

Pay Cash

Tender Stock

Cashless

Figure 8-1. Stock design possibilities

Long-term plans typically require some form of discounting to give them a present value

and thereby permit valuation versus salary and short-term incentives.

All payouts are subject to ordinary income tax except where a cost basis has been estab-

lished either through investment or making a Section 83(b) election to be taxed currently on

a no-investment plan when receipt is deferred to a future date. The company will of course

receive a tax deduction on the same date the individual is taxed at ordinary income tax rates.

The company has no tax deduction if the individual is taxed at long-term capital gains rate.