Page 458 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 458

444 The Complete Guide to Executive Compensation

Stock Option Rescissions. Permitting optionees to cancel exercised options and returning the

shares in order to restore the terms of the exercised grant is another bad idea. Accounting,

tax, and SEC issues abound.

Tax Liability Deferral

The exercise of a nonstatutory (i.e., nonqualified) stock option triggers a taxable event

regardless of whether the cost obligation is satisfied by cash or with stock. However, tax-

liability deferral is possible if elected at least six months prior to exercise of the option and in

conformance with Section 409A (“Nonqualified Deferred Compensation”) of the Internal

Revenue Code.

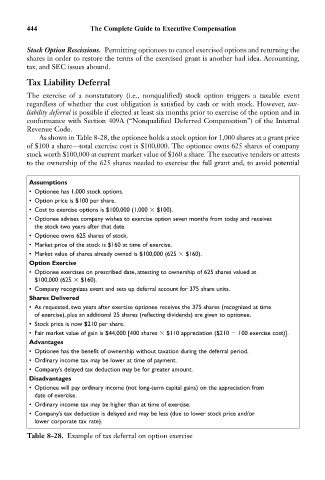

As shown in Table 8-28, the optionee holds a stock option for 1,000 shares at a grant price

of $100 a share—total exercise cost is $100,000. The optionee owns 625 shares of company

stock worth $100,000 at current market value of $160 a share. The executive tenders or attests

to the ownership of the 625 shares needed to exercise the full grant and, to avoid potential

Assumptions

• Optionee has 1,000 stock options.

• Option price is $100 per share.

• Cost to exercise options is $100,000 (1,000 $100).

• Optionee advises company wishes to exercise option seven months from today and receives

the stock two years after that date.

• Optionee owns 625 shares of stock.

• Market price of the stock is $160 at time of exercise.

• Market value of shares already owned is $100,000 (625 $160).

Option Exercise

• Optionee exercises on prescribed date, attesting to ownership of 625 shares valued at

$100,000 (625 $160).

• Company recognizes event and sets up deferral account for 375 share units.

Shares Delivered

• As requested, two years after exercise optionee receives the 375 shares (recognized at time

of exercise), plus an additional 25 shares (reflecting dividends) are given to optionee.

• Stock price is now $210 per share.

• Fair market value of gain is $44,000 [400 shares $110 appreciation ($210 100 exercise cost)].

Advantages

• Optionee has the benefit of ownership without taxation during the deferral period.

• Ordinary income tax may be lower at time of payment.

• Company’s delayed tax deduction may be for greater amount.

Disadvantages

• Optionee will pay ordinary income (not long-term capital gains) on the appreciation from

date of exercise.

• Ordinary income tax may be higher than at time of exercise.

• Company’s tax deduction is delayed and may be less (due to lower stock price and/or

lower corporate tax rate).

Table 8-28. Example of tax deferral on option exercise