Page 534 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 534

520 The Complete Guide to Executive Compensation

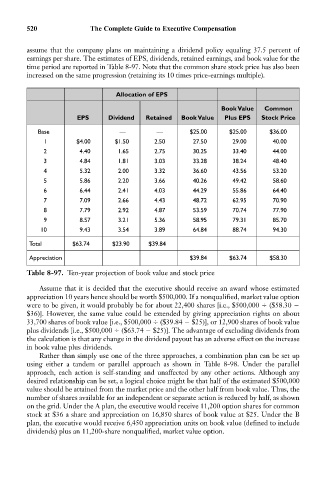

assume that the company plans on maintaining a dividend policy equaling 37.5 percent of

earnings per share. The estimates of EPS, dividends, retained earnings, and book value for the

time period are reported in Table 8-97. Note that the common share stock price has also been

increased on the same progression (retaining its 10 times price-earnings multiple).

Allocation of EPS

Book Value Common

EPS Dividend Retained Book Value Plus EPS Stock Price

Base — — $25.00 $25.00 $36.00

1 $4.00 $1.50 2.50 27.50 29.00 40.00

2 4.40 1.65 2.75 30.25 33.40 44.00

3 4.84 1.81 3.03 33.28 38.24 48.40

4 5.32 2.00 3.32 36.60 43.56 53.20

5 5.86 2.20 3.66 40.26 49.42 58.60

6 6.44 2.41 4.03 44.29 55.86 64.40

7 7.09 2.66 4.43 48.72 62.95 70.90

8 7.79 2.92 4.87 53.59 70.74 77.90

9 8.57 3.21 5.36 58.95 79.31 85.70

10 9.43 3.54 3.89 64.84 88.74 94.30

Total $63.74 $23.90 $39.84

Appreciation $39.84 $63.74 $58.30

Table 8-97. Ten-year projection of book value and stock price

Assume that it is decided that the executive should receive an award whose estimated

appreciation 10 years hence should be worth $500,000. If a nonqualified, market value option

were to be given, it would probably be for about 22,400 shares [i.e., $500,000 ($58.30

$36)]. However, the same value could be extended by giving appreciation rights on about

33,700 shares of book value [i.e., $500,000 ($39.84 $25)], or 12,900 shares of book value

plus dividends [i.e., $500,000 ($63.74 $25)]. The advantage of excluding dividends from

the calculation is that any change in the dividend payout has an adverse effect on the increase

in book value plus dividends.

Rather than simply use one of the three approaches, a combination plan can be set up

using either a tandem or parallel approach as shown in Table 8-98. Under the parallel

approach, each action is self-standing and unaffected by any other actions. Although any

desired relationship can be set, a logical choice might be that half of the estimated $500,000

value should be attained from the market price and the other half from book value. Thus, the

number of shares available for an independent or separate action is reduced by half, as shown

on the grid. Under the A plan, the executive would receive 11,200 option shares for common

stock at $36 a share and appreciation on 16,850 shares of book value at $25. Under the B

plan, the executive would receive 6,450 appreciation units on book value (defined to include

dividends) plus an 11,200-share nonqualified, market value option.