Page 570 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 570

556 The Complete Guide to Executive Compensation

Incentives

Performance

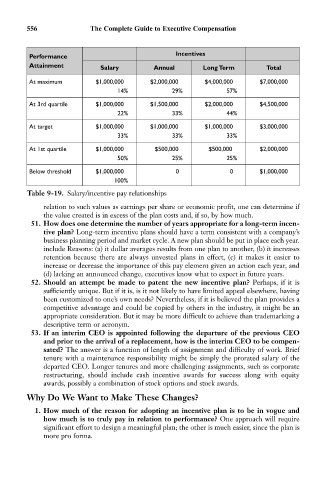

Attainment Salary Annual Long Term Total

At maximum $1,000,000 $2,000,000 $4,000,000 $7,000,000

14% 29% 57%

At 3rd quartile $1,000,000 $1,500,000 $2,000,000 $4,500,000

22% 33% 44%

At target $1,000,000 $1,000,000 $1,000,000 $3,000,000

33% 33% 33%

At 1st quartile $1,000,000 $500,000 $500,000 $2,000,000

50% 25% 25%

Below threshold $1,000,000 0 0 $1,000,000

100%

Table 9-19. Salary/incentive pay relationships

relation to such values as earnings per share or economic profit, one can determine if

the value created is in excess of the plan costs and, if so, by how much.

51. How does one determine the number of years appropriate for a long-term incen-

tive plan? Long-term incentive plans should have a term consistent with a company’s

business planning period and market cycle. A new plan should be put in place each year.

include Reasons: (a) it dollar averages results from one plan to another, (b) it increases

retention because there are always unvested plans in effect, (c) it makes it easier to

increase or decrease the importance of this pay element given an action each year, and

(d) lacking an announced change, executives know what to expect in future years.

52. Should an attempt be made to patent the new incentive plan? Perhaps, if it is

sufficiently unique. But if it is, is it not likely to have limited appeal elsewhere, having

been customized to one’s own needs? Nevertheless, if it is believed the plan provides a

competitive advantage and could be copied by others in the industry, it might be an

appropriate consideration. But it may be more difficult to achieve than trademarking a

descriptive term or acronym.

53. If an interim CEO is appointed following the departure of the previous CEO

and prior to the arrival of a replacement, how is the interim CEO to be compen-

sated? The answer is a function of length of assignment and difficulty of work. Brief

tenure with a maintenance responsibility might be simply the prorated salary of the

departed CEO. Longer tenures and more challenging assignments, such as corporate

restructuring, should include cash incentive awards for success along with equity

awards, possibly a combination of stock options and stock awards.

Why Do We Want to Make These Changes?

1. How much of the reason for adopting an incentive plan is to be in vogue and

how much is to truly pay in relation to performance? One approach will require

significant effort to design a meaningful plan; the other is much easier, since the plan is

more pro forma.