Page 680 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 680

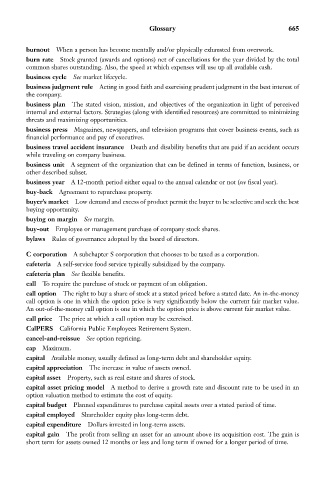

Glossary 665

burnout When a person has become mentally and/or physically exhausted from overwork.

burn rate Stock granted (awards and options) net of cancellations for the year divided by the total

common shares outstanding. Also, the speed at which expenses will use up all available cash.

business cycle See market lifecycle.

business judgment rule Acting in good faith and exercising prudent judgment in the best interest of

the company.

business plan The stated vision, mission, and objectives of the organization in light of perceived

internal and external factors. Strategies (along with identified resources) are committed to minimizing

threats and maximizing opportunities.

business press Magazines, newspapers, and television programs that cover business events, such as

financial performance and pay of executives.

business travel accident insurance Death and disability benefits that are paid if an accident occurs

while traveling on company business.

business unit A segment of the organization that can be defined in terms of function, business, or

other described subset.

business year A 12-month period either equal to the annual calendar or not (see fiscal year).

buy-back Agreement to repurchase property.

buyer’s market Low demand and excess of product permit the buyer to be selective and seek the best

buying opportunity.

buying on margin See margin.

buy-out Employee or management purchase of company stock shares.

bylaws Rules of governance adopted by the board of directors.

C corporation A subchapter S corporation that chooses to be taxed as a corporation.

cafeteria A self-service food service typically subsidized by the company.

cafeteria plan See flexible benefits.

call To require the purchase of stock or payment of an obligation.

call option The right to buy a share of stock at a stated priced before a stated date. An in-the-money

call option is one in which the option price is very significantly below the current fair market value.

An out-of-the-money call option is one in which the option price is above current fair market value.

call price The price at which a call option may be exercised.

CalPERS California Public Employees Retirement System.

cancel-and-reissue See option repricing.

cap Maximum.

capital Available money, usually defined as long-term debt and shareholder equity.

capital appreciation The increase in value of assets owned.

capital asset Property, such as real estate and shares of stock.

capital asset pricing model A method to derive a growth rate and discount rate to be used in an

option valuation method to estimate the cost of equity.

capital budget Planned expenditures to purchase capital assets over a stated period of time.

capital employed Shareholder equity plus long-term debt.

capital expenditure Dollars invested in long-term assets.

capital gain The profit from selling an asset for an amount above its acquisition cost. The gain is

short term for assets owned 12 months or less and long term if owned for a longer period of time.