Page 732 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 732

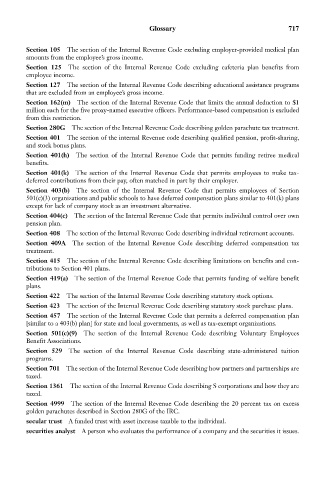

Glossary 717

Section 105 The section of the Internal Revenue Code excluding employer-provided medical plan

amounts from the employee’s gross income.

Section 125 The section of the Internal Revenue Code excluding cafeteria plan benefits from

employee income.

Section 127 The section of the Internal Revenue Code describing educational assistance programs

that are excluded from an employee’s gross income.

Section 162(m) The section of the Internal Revenue Code that limits the annual deduction to $1

million each for the five proxy-named executive officers. Performance-based compensation is excluded

from this restriction.

Section 280G The section of the Internal Revenue Code describing golden parachute tax treatment.

Section 401 The section of the internal Revenue code describing qualified pension, profit-sharing,

and stock bonus plans.

Section 401(h) The section of the Internal Revenue Code that permits funding retiree medical

benefits.

Section 401(k) The section of the Internal Revenue Code that permits employees to make tax-

deferred contributions from their pay, often matched in part by their employer.

Section 403(b) The section of the Internal Revenue Code that permits employees of Section

501(c)(3) organizations and public schools to have deferred compensation plans similar to 401(k) plans

except for lack of company stock as an investment alternative.

Section 404(c) The section of the Internal Revenue Code that permits individual control over own

pension plan.

Section 408 The section of the Internal Revenue Code describing individual retirement accounts.

Section 409A The section of the Internal Revenue Code describing deferred compensation tax

treatment.

Section 415 The section of the Internal Revenue Code describing limitations on benefits and con-

tributions to Section 401 plans.

Section 419(a) The section of the Internal Revenue Code that permits funding of welfare benefit

plans.

Section 422 The section of the Internal Revenue Code describing statutory stock options.

Section 423 The section of the Internal Revenue Code describing statutory stock purchase plans.

Section 457 The section of the Internal Revenue Code that permits a deferred compensation plan

[similar to a 403(b) plan] for state and local governments, as well as tax-exempt organizations.

Section 501(c)(9) The section of the Internal Revenue Code describing Voluntary Employees

Benefit Associations.

Section 529 The section of the Internal Revenue Code describing state-administered tuition

programs.

Section 701 The section of the Internal Revenue Code describing how partners and partnerships are

taxed.

Section 1361 The section of the Internal Revenue Code describing S corporations and how they are

taxed.

Section 4999 The section of the Internal Revenue Code describing the 20 percent tax on excess

golden parachutes described in Section 280G of the IRC.

secular trust A funded trust with asset increase taxable to the individual.

securities analyst A person who evaluates the performance of a company and the securities it issues.