Page 357 - Wastewater Solids Incineration Systems

P. 357

318 Wastewater Solids Incineration Systems

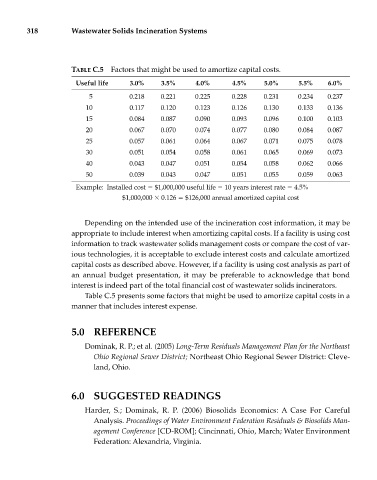

TABLE C.5 Factors that might be used to amortize capital costs.

Useful life 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0%

5 0.218 0.221 0.225 0.228 0.231 0.234 0.237

10 0.117 0.120 0.123 0.126 0.130 0.133 0.136

15 0.084 0.087 0.090 0.093 0.096 0.100 0.103

20 0.067 0.070 0.074 0.077 0.080 0.084 0.087

25 0.057 0.061 0.064 0.067 0.071 0.075 0.078

30 0.051 0.054 0.058 0.061 0.065 0.069 0.073

40 0.043 0.047 0.051 0.054 0.058 0.062 0.066

50 0.039 0.043 0.047 0.051 0.055 0.059 0.063

Example: Installed cost $1,000,000 useful life 10 years interest rate 4.5%

$1,000,000 0.126 $126,000 annual amortized capital cost

Depending on the intended use of the incineration cost information, it may be

appropriate to include interest when amortizing capital costs. If a facility is using cost

information to track wastewater solids management costs or compare the cost of var-

ious technologies, it is acceptable to exclude interest costs and calculate amortized

capital costs as described above. However, if a facility is using cost analysis as part of

an annual budget presentation, it may be preferable to acknowledge that bond

interest is indeed part of the total financial cost of wastewater solids incinerators.

Table C.5 presents some factors that might be used to amortize capital costs in a

manner that includes interest expense.

5.0 REFERENCE

Dominak, R. P.; et al. (2005) Long-Term Residuals Management Plan for the Northeast

Ohio Regional Sewer District; Northeast Ohio Regional Sewer District: Cleve-

land, Ohio.

6.0 SUGGESTED READINGS

Harder, S.; Dominak, R. P. (2006) Biosolids Economics: A Case For Careful

Analysis. Proceedings of Water Environment Federation Residuals & Biosolids Man-

agement Conference [CD-ROM]; Cincinnati, Ohio, March; Water Environment

Federation: Alexandria, Virginia.