Page 208 - Accounting Best Practices

P. 208

c10.qxd 7/31/03 3:12 PM Page 197

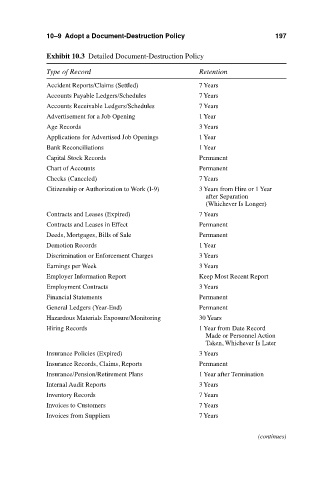

10–9 Adopt a Document-Destruction Policy

Exhibit 10.3 Detailed Document-Destruction Policy 197

Type of Record Retention

Accident Reports/Claims (Settled) 7 Years

Accounts Payable Ledgers/Schedules 7 Years

Accounts Receivable Ledgers/Schedules 7 Years

Advertisement for a Job Opening 1 Year

Age Records 3 Years

Applications for Advertised Job Openings 1 Year

Bank Reconciliations 1 Year

Capital Stock Records Permanent

Chart of Accounts Permanent

Checks (Canceled) 7 Years

Citizenship or Authorization to Work (I-9) 3 Years from Hire or 1 Year

after Separation

(Whichever Is Longer)

Contracts and Leases (Expired) 7 Years

Contracts and Leases in Effect Permanent

Deeds, Mortgages, Bills of Sale Permanent

Demotion Records 1 Year

Discrimination or Enforcement Charges 3 Years

Earnings per Week 3 Years

Employer Information Report Keep Most Recent Report

Employment Contracts 3 Years

Financial Statements Permanent

General Ledgers (Year-End) Permanent

Hazardous Materials Exposure/Monitoring 30 Years

Hiring Records 1 Year from Date Record

Made or Personnel Action

Taken, Whichever Is Later

Insurance Policies (Expired) 3 Years

Insurance Records, Claims, Reports Permanent

Insurance/Pension/Retirement Plans 1 Year after Termination

Internal Audit Reports 3 Years

Inventory Records 7 Years

Invoices to Customers 7 Years

Invoices from Suppliers 7 Years

(continues)