Page 293 - Analysis, Synthesis and Design of Chemical Processes, Third Edition

P. 293

23. contribution every year for 40 years, beginning at age 25 until age 65.

a. What is the future value of this retirement fund after 40 years, assuming an effective annual

interest rate of 9%?

b. What effective annual interest rate is required for the future value of this investment to be $2

million after 40 years?

You plan to finance a new car by borrowing $25,000. The interest rate is 7% p.a., compounded

24. monthly. What is your monthly payment for a three-year loan, a four-year loan, and for a five-year

loan?

You have just purchased a new car by borrowing $20,000 for four years. Your monthly payment is

25.

$500. What is your nominal interest rate if compounded monthly?

You plan to borrow $200,000 to purchase a new house. The nominal interest rate fixed at 6.5% p.a.,

compounded monthly.

26. a. What is the monthly payment on a 30-year mortgage?

b. What is the monthly payment on a 15-year mortgage?

c. What is the difference in the amount of interest paid over the lifetime of each loan?

You just borrowed $225,000 to purchase a new house. The monthly payment (before taxes and

27.

insurance) is $1791 for the 25-year loan. What is the effective annual interest rate?

You just borrowed $250,000 to purchase a new house. The nominal interest rate is 6% p.a.,

28. compounded monthly, and the monthly payment is $1612 for the loan. What is the duration of the

loan?

A home-equity loan involves borrowing against the equity in a house. For example, if your house is

valued at $250,000 and you have been paying the mortgage for a sufficient amount of time, you may

owe only $150,000 on the mortgage. Therefore, your equity in the home is $100,000. You can use the

home as collateral for a loan, possibly up to $100,000, depending on the bank’s policy. Home-equity

29. loans often have shorter durations than regular mortgages. Suppose that you take a home-equity loan

of $50,000 for the down payment on a new house in a new location because you have a new job.

When you complete the sale of your old house, the home-equity loan will be paid off at the closing.

The home-equity loan terms are a 10-year term at 7% p.a., compounded monthly, but you must also

pay 0.05% of the original high-equity loan principal each month. What is the monthly payment?

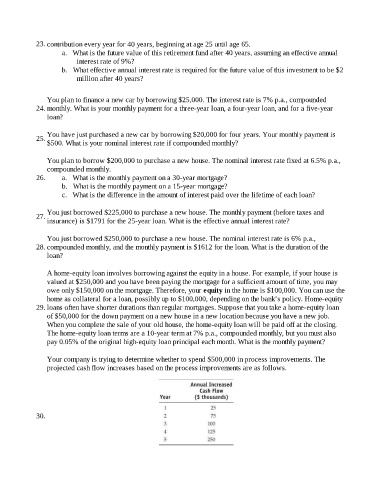

Your company is trying to determine whether to spend $500,000 in process improvements. The

projected cash flow increases based on the process improvements are as follows.

30.