Page 290 - Analysis, Synthesis and Design of Chemical Processes, Third Edition

P. 290

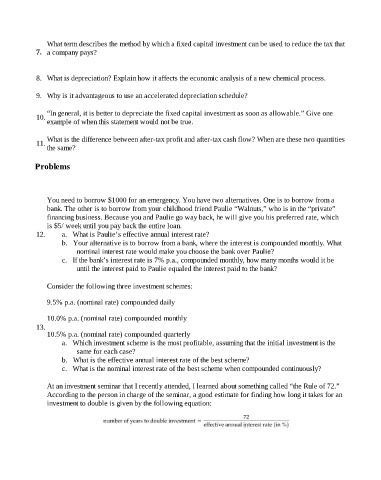

What term describes the method by which a fixed capital investment can be used to reduce the tax that

7. a company pays?

8. What is depreciation? Explain how it affects the economic analysis of a new chemical process.

9. Why is it advantageous to use an accelerated depreciation schedule?

“In general, it is better to depreciate the fixed capital investment as soon as allowable.” Give one

10.

example of when this statement would not be true.

What is the difference between after-tax profit and after-tax cash flow? When are these two quantities

11.

the same?

Problems

You need to borrow $1000 for an emergency. You have two alternatives. One is to borrow from a

bank. The other is to borrow from your childhood friend Paulie “Walnuts,” who is in the “private”

financing business. Because you and Paulie go way back, he will give you his preferred rate, which

is $5/ week until you pay back the entire loan.

12. a. What is Paulie’s effective annual interest rate?

b. Your alternative is to borrow from a bank, where the interest is compounded monthly. What

nominal interest rate would make you choose the bank over Paulie?

c. If the bank’s interest rate is 7% p.a., compounded monthly, how many months would it be

until the interest paid to Paulie equaled the interest paid to the bank?

Consider the following three investment schemes:

9.5% p.a. (nominal rate) compounded daily

10.0% p.a. (nominal rate) compounded monthly

13.

10.5% p.a. (nominal rate) compounded quarterly

a. Which investment scheme is the most profitable, assuming that the initial investment is the

same for each case?

b. What is the effective annual interest rate of the best scheme?

c. What is the nominal interest rate of the best scheme when compounded continuously?

At an investment seminar that I recently attended, I learned about something called “the Rule of 72.”

According to the person in charge of the seminar, a good estimate for finding how long it takes for an

investment to double is given by the following equation: