Page 83 - Biorefinery 2030 Future Prospects for the Bioeconomy (2015)

P. 83

2 Changes in the Environment that made the Bazancourt-Pomacle Biorefinery 51

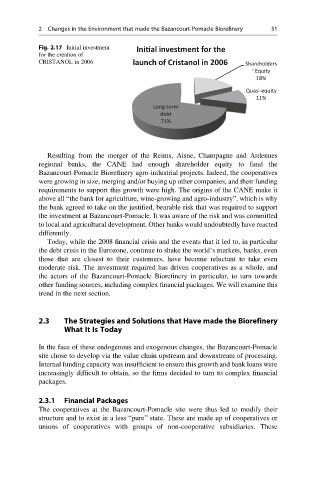

Fig. 2.17 Initial investment Ini al investment for the

for the creation of

CRISTANOL in 2006 launch of Cristanol in 2006 Shareholders

’ Equity

18%

Quasi-equity

11%

Long-term

debt

71%

Resulting from the merger of the Reims, Aisne, Champagne and Ardennes

regional banks, the CANE had enough shareholder equity to fund the

Bazancourt-Pomacle Biorefinery agro-industrial projects. Indeed, the cooperatives

were growing in size, merging and/or buying up other companies, and their funding

requirements to support this growth were high. The origins of the CANE make it

above all “the bank for agriculture, wine-growing and agro-industry”, which is why

the bank agreed to take on the justified, bearable risk that was required to support

the investment at Bazancourt-Pomacle. It was aware of the risk and was committed

to local and agricultural development. Other banks would undoubtedly have reacted

differently.

Today, while the 2008 financial crisis and the events that it led to, in particular

the debt crisis in the Eurozone, continue to shake the world’s markets, banks, even

those that are closest to their customers, have become reluctant to take even

moderate risk. The investment required has driven cooperatives as a whole, and

the actors of the Bazancourt-Pomacle Biorefinery in particular, to turn towards

other funding sources, including complex financial packages. We will examine this

trend in the next section.

2.3 The Strategies and Solutions that Have made the Biorefinery

What It Is Today

In the face of these endogenous and exogenous changes, the Bazancourt-Pomacle

site chose to develop via the value chain upstream and downstream of processing.

Internal funding capacity was insufficient to ensure this growth and bank loans were

increasingly difficult to obtain, so the firms decided to turn to complex financial

packages.

2.3.1 Financial Packages

The cooperatives at the Bazancourt-Pomacle site were thus led to modify their

structure and to exist in a less “pure” state. These are made up of cooperatives or

unions of cooperatives with groups of non-cooperative subsidiaries. These