Page 166 - Budgeting for Managers

P. 166

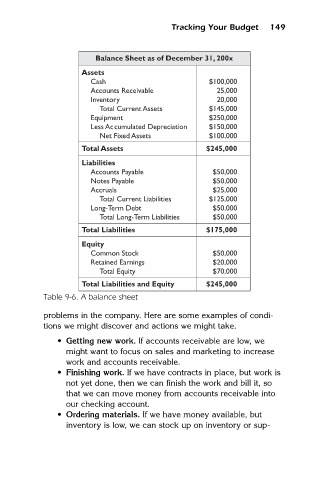

Balance Sheet as of December 31, 200x

Assets

Cash

$100,000

Accounts Receivable Tracking Your Budget 149

25,000

Inventory 20,000

Total Current Assets $145,000

Equipment $250,000

Less Accumulated Depreciation $150,000

Net Fixed Assets $100,000

Total Assets $245,000

Liabilities

Accounts Payable $50,000

Notes Payable $50,000

Accruals $25,000

Total Current Liabilities $125,000

Long-Term Debt $50,000

Total Long-Term Liabilities $50,000

Total Liabilities $175,000

Equity

Common Stock $50,000

Retained Earnings $20,000

Total Equity $70,000

Total Liabilities and Equity $245,000

Table 9-6. A balance sheet

problems in the company. Here are some examples of condi-

tions we might discover and actions we might take.

• Getting new work. If accounts receivable are low, we

might want to focus on sales and marketing to increase

work and accounts receivable.

• Finishing work. If we have contracts in place, but work is

not yet done, then we can finish the work and bill it, so

that we can move money from accounts receivable into

our checking account.

• Ordering materials. If we have money available, but

inventory is low, we can stock up on inventory or sup-