Page 161 - Budgeting for Managers

P. 161

Budgeting for Managers

necessary, borrowing money from a line of credit.

loans, and lines of credit that are due or will be due before

the end of the month so that we do not incur penalties,

144 • Paying bills and loans. We pay all bills, credit cards,

aggravate our vendors, or have unresolved items when we

close our books.

When we have completed all the transactions we can and

TEAMFLY

the accounting department has balanced the books and recon-

ciled all accounts, then the books can be closed and a final ver-

sion of the financial statements can be prepared.

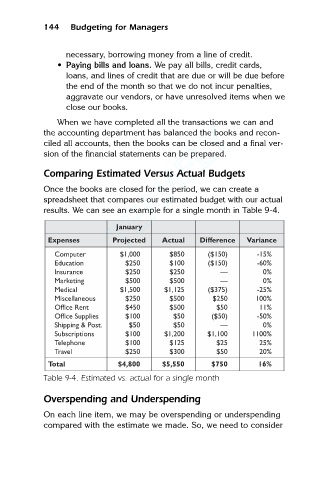

Comparing Estimated Versus Actual Budgets

Once the books are closed for the period, we can create a

spreadsheet that compares our estimated budget with our actual

results. We can see an example for a single month in Table 9-4.

January

Expenses Projected Actual Difference Variance

Computer $1,000 $850 ($150) -15%

$100

$250

($150)

Education

-60%

Insurance $250 $250 — 0%

Marketing $500 $500 — 0%

-25%

Medical $1,500 $1,125 ($375) 100%

Miscellaneous

$250

$250

$500

Office Rent $450 $500 $50 11%

Office Supplies $100 $50 ($50) -50%

Shipping & Post. $50 $50 — 0%

Subscriptions $100 $1,200 $1,100 1100%

$100

$125

$25

Telephone

25%

Travel $250 $300 $50 20%

Total $4,800 $5,550 $750 16%

Table 9-4. Estimated vs. actual for a single month

Overspending and Underspending

On each line item, we may be overspending or underspending

compared with the estimate we made. So, we need to consider

Team-Fly

®