Page 159 - Budgeting for Managers

P. 159

142

Client 1

Total

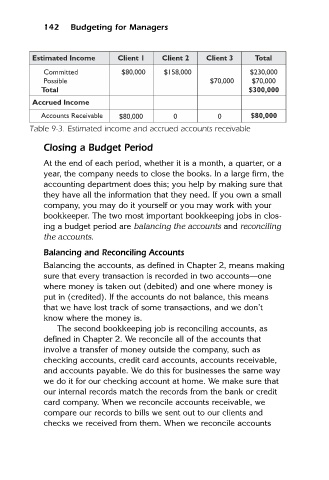

Estimated Income

Client 2

$158,000

Committed

$80,000

$230,000

$70,000

Possible

$70,000

Total Budgeting for Managers Client 3 $300,000

Accrued Income

Accounts Receivable $80,000 0 0 $80,000

Table 9-3. Estimated income and accrued accounts receivable

Closing a Budget Period

At the end of each period, whether it is a month, a quarter, or a

year, the company needs to close the books. In a large firm, the

accounting department does this; you help by making sure that

they have all the information that they need. If you own a small

company, you may do it yourself or you may work with your

bookkeeper. The two most important bookkeeping jobs in clos-

ing a budget period are balancing the accounts and reconciling

the accounts.

Balancing and Reconciling Accounts

Balancing the accounts, as defined in Chapter 2, means making

sure that every transaction is recorded in two accounts—one

where money is taken out (debited) and one where money is

put in (credited). If the accounts do not balance, this means

that we have lost track of some transactions, and we don’t

know where the money is.

The second bookkeeping job is reconciling accounts, as

defined in Chapter 2. We reconcile all of the accounts that

involve a transfer of money outside the company, such as

checking accounts, credit card accounts, accounts receivable,

and accounts payable. We do this for businesses the same way

we do it for our checking account at home. We make sure that

our internal records match the records from the bank or credit

card company. When we reconcile accounts receivable, we

compare our records to bills we sent out to our clients and

checks we received from them. When we reconcile accounts