Page 155 - Budgeting for Managers

P. 155

Budgeting for Managers

138

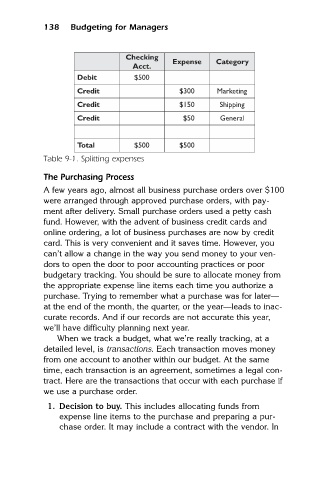

Acct.

$500

Debit

Credit Checking Expense Category

Marketing

$300

Credit $150 Shipping

Credit $50 General

Total $500 $500

Table 9-1. Splitting expenses

The Purchasing Process

A few years ago, almost all business purchase orders over $100

were arranged through approved purchase orders, with pay-

ment after delivery. Small purchase orders used a petty cash

fund. However, with the advent of business credit cards and

online ordering, a lot of business purchases are now by credit

card. This is very convenient and it saves time. However, you

can’t allow a change in the way you send money to your ven-

dors to open the door to poor accounting practices or poor

budgetary tracking. You should be sure to allocate money from

the appropriate expense line items each time you authorize a

purchase. Trying to remember what a purchase was for later—

at the end of the month, the quarter, or the year—leads to inac-

curate records. And if our records are not accurate this year,

we’ll have difficulty planning next year.

When we track a budget, what we’re really tracking, at a

detailed level, is transactions. Each transaction moves money

from one account to another within our budget. At the same

time, each transaction is an agreement, sometimes a legal con-

tract. Here are the transactions that occur with each purchase if

we use a purchase order.

1. Decision to buy. This includes allocating funds from

expense line items to the purchase and preparing a pur-

chase order. It may include a contract with the vendor. In