Page 181 - Budgeting for Managers

P. 181

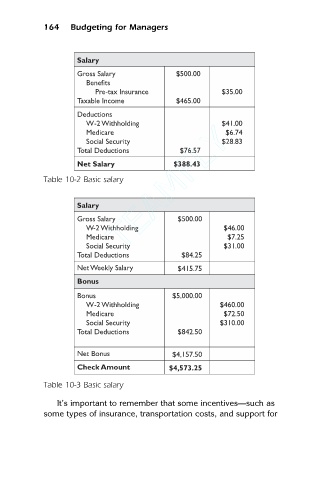

Salary

Gross Salary

Benefits

Pre-tax Insurance

164 Budgeting for Managers $500.00 $35.00

Taxable Income

$465.00

Deductions

W-2 Withholding $41.00

Medicare $6.74

Social Security $28.83

Total Deductions $76.57

Net Salary $388.43

Table 10-2 Basic salary

TEAMFLY

Salary

Gross Salary $500.00 $46.00

W-2 Withholding

Medicare $7.25

Social Security $31.00

Total Deductions $84.25

Net Weekly Salary $415.75

Bonus

Bonus $5,000.00

W-2 Withholding $460.00

Medicare $72.50

Social Security

Total Deductions $842.50 $310.00

Net Bonus $4,157.50

Check Amount $4,573.25

Table 10-3 Basic salary

It’s important to remember that some incentives—such as

some types of insurance, transportation costs, and support for

®

Team-Fly