Page 179 - Budgeting for Managers

P. 179

Budgeting for Managers

162

Do not try to do this yourself. The rules are very complicated,

they vary from state to state, they change frequently, and they

vary with each worker’s pay rate and number of family mem-

bers. We’re introducing the topic in this chapter only so that you

can understand what payroll will do, not so that you can try to

do it yourself.

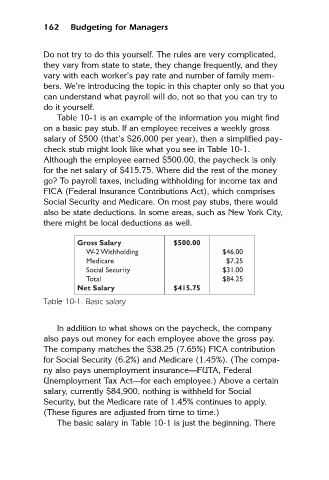

Table 10-1 is an example of the information you might find

on a basic pay stub. If an employee receives a weekly gross

salary of $500 (that’s $26,000 per year), then a simplified pay-

check stub might look like what you see in Table 10-1.

Although the employee earned $500.00, the paycheck is only

for the net salary of $415.75. Where did the rest of the money

go? To payroll taxes, including withholding for income tax and

FICA (Federal Insurance Contributions Act), which comprises

Social Security and Medicare. On most pay stubs, there would

also be state deductions. In some areas, such as New York City,

there might be local deductions as well.

Gross Salary $500.00

W-2 Withholding $46.00

Medicare $7.25

Social Security $31.00

Total $84.25

Net Salary $415.75

Table 10-1. Basic salary

In addition to what shows on the paycheck, the company

also pays out money for each employee above the gross pay.

The company matches the $38.25 (7.65%) FICA contribution

for Social Security (6.2%) and Medicare (1.45%). (The compa-

ny also pays unemployment insurance—FUTA, Federal

Unemployment Tax Act—for each employee.) Above a certain

salary, currently $84,900, nothing is withheld for Social

Security, but the Medicare rate of 1.45% continues to apply.

(These figures are adjusted from time to time.)

The basic salary in Table 10-1 is just the beginning. There