Page 212 - Budgeting for Managers

P. 212

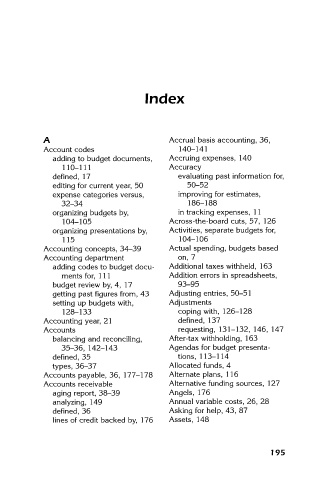

Index

A Accrual basis accounting, 36,

Account codes 140–141

adding to budget documents, Accruing expenses, 140

110–111 Accuracy

defined, 17 evaluating past information for,

editing for current year, 50 50–52

expense categories versus, improving for estimates,

32–34 186–188

organizing budgets by, in tracking expenses, 11

104–105 Across-the-board cuts, 57, 126

organizing presentations by, Activities, separate budgets for,

115 104–106

Accounting concepts, 34–39 Actual spending, budgets based

Accounting department on, 7

adding codes to budget docu- Additional taxes withheld, 163

ments for, 111 Addition errors in spreadsheets,

budget review by, 4, 17 93–95

getting past figures from, 43 Adjusting entries, 50–51

setting up budgets with, Adjustments

128–133 coping with, 126–128

Accounting year, 21 defined, 137

Accounts requesting, 131–132, 146, 147

balancing and reconciling, After-tax withholding, 163

35–36, 142–143 Agendas for budget presenta-

defined, 35 tions, 113–114

types, 36–37 Allocated funds, 4

Accounts payable, 36, 177–178 Alternate plans, 116

Accounts receivable Alternative funding sources, 127

aging report, 38–39 Angels, 176

analyzing, 149 Annual variable costs, 26, 28

defined, 36 Asking for help, 43, 87

lines of credit backed by, 176 Assets, 148

195