Page 139 -

P. 139

Accounting in ERP Systems

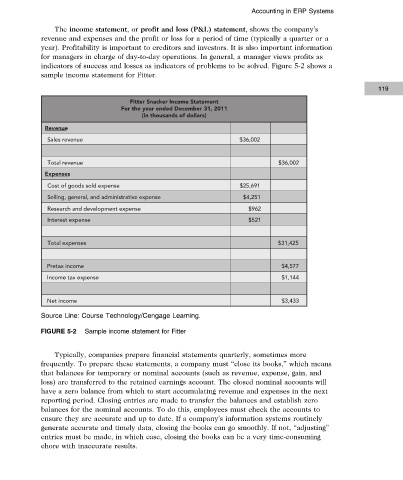

The income statement,or profit and loss (P&L) statement, shows the company’s

revenue and expenses and the profit or loss for a period of time (typically a quarter or a

year). Profitability is important to creditors and investors. It is also important information

for managers in charge of day-to-day operations. In general, a manager views profits as

indicators of success and losses as indicators of problems to be solved. Figure 5-2 shows a

sample income statement for Fitter.

119

Fitter Snacker Income Statement

For the year ended December 31, 2011

(in thousands of dollars)

Revenue

Sales revenue $36,002

Total revenue $36,002

Expenses

C o g f o t s o o d s s e d l o x p e n s e $ 2 6 , 5 9 1

S n i l l e g , g e n a , l a r e n a d d m v i t a r t s i n i e e x p e n s e $ 2 , 4 5 1

R e s e c r a a h n d d e v o l e p m e e t n x p e n s e $ 9 6 2

Interest expense $521

Total expenses $31,425

Pretax income $4,577

Income tax expense $1,144

Net income $3,433

Source Line: Course Technology/Cengage Learning.

FIGURE 5-2 Sample income statement for Fitter

Typically, companies prepare financial statements quarterly, sometimes more

frequently. To prepare these statements, a company must “close its books,” which means

that balances for temporary or nominal accounts (such as revenue, expense, gain, and

loss) are transferred to the retained earnings account. The closed nominal accounts will

have a zero balance from which to start accumulating revenue and expenses in the next

reporting period. Closing entries are made to transfer the balances and establish zero

balances for the nominal accounts. To do this, employees must check the accounts to

ensure they are accurate and up to date. If a company’s information systems routinely

generate accurate and timely data, closing the books can go smoothly. If not, “adjusting”

entries must be made, in which case, closing the books can be a very time-consuming

chore with inaccurate results.

Copyright 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s).

Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.