Page 103 - Critical Political Economy of the Media

P. 103

82 Critical investigations in political economy

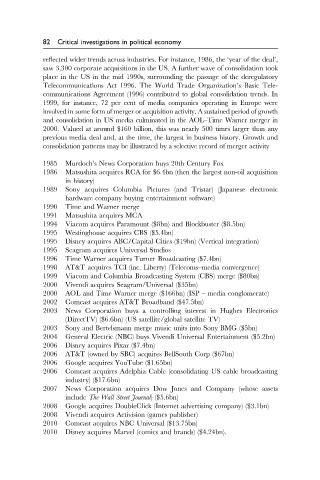

reflected wider trends across industries. For instance, 1986, the ‘year of the deal’,

saw 3,300 corporate acquisitions in the US. A further wave of consolidation took

place in the US in the mid 1990s, surrounding the passage of the deregulatory

Telecommunications Act 1996. The World Trade Organization’s Basic Tele-

communications Agreement (1996) contributed to global consolidation trends. In

1999, for instance, 72 per cent of media companies operating in Europe were

involved in some form of merger or acquisition activity. A sustained period of growth

and consolidation in US media culminated in the AOL–Time Warner merger in

2000. Valued at around $160 billion, this was nearly 500 times larger than any

previous media deal and, at the time, the largest in business history. Growth and

consolidation patterns may be illustrated by a selective record of merger activity

1985 Murdoch’s News Corporation buys 20th Century Fox

1986 Matsushita acquires RCA for $6.4bn (then the largest non-oil acquisition

in history)

1989 Sony acquires Columbia Pictures (and Tristar) (Japanese electronic

hardware company buying entertainment software)

1990 Time and Warner merge

1991 Matsushita acquires MCA

1994 Viacom acquires Paramount ($8bn) and Blockbuster ($8.5bn)

1995 Westinghouse acquires CBS ($5.4bn)

1995 Disney acquires ABC/Capital Cities ($19bn) (Vertical integration)

1995 Seagram acquires Universal Studios

1996 Time Warner acquires Turner Broadcasting ($7.4bn)

1998 AT&T acquires TCI (inc. Liberty) (Telecoms–media convergence)

1999 Viacom and Columbia Broadcasting System (CBS) merge ($80bn)

2000 Vivendi acquires Seagram/Universal ($35bn)

2000 AOL and Time Warner merge ($166bn) (ISP – media conglomerate)

2002 Comcast acquires AT&T Broadband ($47.5bn)

2003 News Corporation buys a controlling interest in Hughes Electronics

(DirectTV) ($6.6bn) (US satellite/global satellite TV)

2003 Sony and Bertelsmann merge music units into Sony BMG ($5bn)

2004 General Electric (NBC) buys Vivendi Universal Entertainment ($5.2bn)

2006 Disney acquires Pixar ($7.4bn)

2006 AT&T (owned by SBC) acquires BellSouth Corp ($67bn)

2006 Google acquires YouTube ($1.65bn)

2006 Comcast acquires Adelphia Cable (consolidating US cable broadcasting

industry) ($17.6bn)

2007 News Corporation acquires Dow Jones and Company (whose assets

include The Wall Street Journal) ($5.6bn)

2008 Google acquires DoubleClick (Internet advertising company) ($3.1bn)

2008 Vivendi acquires Activision (games publisher)

2010 Comcast acquires NBC Universal ($13.75bn)

2010 Disney acquires Marvel (comics and brands) ($4.24bn).