Page 107 - Critical Political Economy of the Media

P. 107

86 Critical investigations in political economy

such as Google and Apple combine all three while remaining principally media

content distributors rather than content creators.

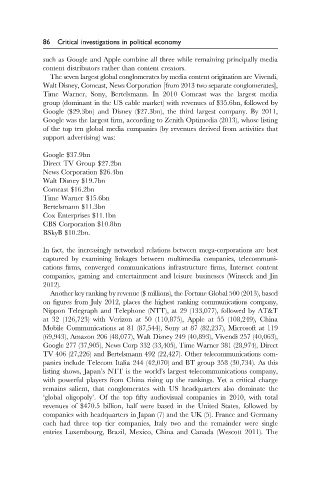

The seven largest global conglomerates by media content origination are Vivendi,

Walt Disney, Comcast, News Corporation [from 2013 two separate conglomerates],

Time Warner, Sony, Bertelsmann. In 2010 Comcast was the largest media

group (dominant in the US cable market) with revenues of $35.6bn, followed by

Google ($29.3bn) and Disney ($27.3bn), the third largest company. By 2011,

Google was the largest firm, according to Zenith Optimedia (2013), whose listing

of the top ten global media companies (by revenues derived from activities that

support advertising) was:

Google $37.9bn

Direct TV Group $27.2bn

News Corporation $26.4bn

Walt Disney $19.7bn

Comcast $16.2bn

Time Warner $15.6bn

Bertelsmann $11.3bn

Cox Enterprises $11.1bn

CBS Corporation $10.8bn

BSkyB $10.2bn.

In fact, the increasingly networked relations between mega-corporations are best

captured by examining linkages between multimedia companies, telecommuni-

cations firms, converged communications infrastructure firms, Internet content

companies, gaming and entertainment and leisure businesses (Winseck and Jin

2012).

Another key ranking by revenue ($ millions), the Fortune Global 500 (2013), based

on figures from July 2012, places the highest ranking communications company,

Nippon Telegraph and Telephone (NTT), at 29 (133,077), followed by AT&T

at 32 (126,723) with Verizon at 50 (110,875), Apple at 55 (108,249), China

Mobile Communications at 81 (87,544), Sony at 87 (82,237), Microsoft at 119

(69,943), Amazon 206 (48,077), Walt Disney 249 (40,893), Vivendi 257 (40,063),

Google 277 (37,905), News Corp 332 (33,405), Time Warner 381 (28,974), Direct

TV 406 (27,226) and Bertelsmann 492 (22,427). Other telecommunications com-

panies include Telecom Italia 244 (42,070) and BT group 358 (30,734). As this

listing shows, Japan’s NTT is the world’s largest telecommunications company,

with powerful players from China rising up the rankings. Yet a critical charge

remains salient, that conglomerates with US headquarters also dominate the

‘global oligopoly’. Of the top fifty audiovisual companies in 2010, with total

revenues of $470.5 billion, half were based in the United States, followed by

companies with headquarters in Japan (7) and the UK (5). France and Germany

each had three top tier companies, Italy two and the remainder were single

entries Luxembourg, Brazil, Mexico, China and Canada (Wescott 2011). The