Page 345 - Data Architecture

P. 345

Chapter 9.1: Repetitive Analytics: Some Basics

Usually, the analysis centers around questions of what else has occurred when the

variable has exceeded the threshold value.

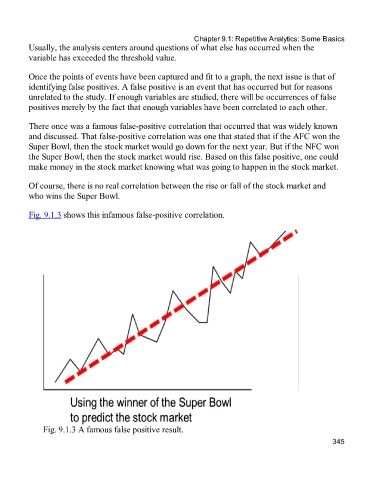

Once the points of events have been captured and fit to a graph, the next issue is that of

identifying false positives. A false positive is an event that has occurred but for reasons

unrelated to the study. If enough variables are studied, there will be occurrences of false

positives merely by the fact that enough variables have been correlated to each other.

There once was a famous false-positive correlation that occurred that was widely known

and discussed. That false-positive correlation was one that stated that if the AFC won the

Super Bowl, then the stock market would go down for the next year. But if the NFC won

the Super Bowl, then the stock market would rise. Based on this false positive, one could

make money in the stock market knowing what was going to happen in the stock market.

Of course, there is no real correlation between the rise or fall of the stock market and

who wins the Super Bowl.

Fig. 9.1.3 shows this infamous false-positive correlation.

Fig. 9.1.3 A famous false positive result.

345