Page 297 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 297

Enabled Organization: Setting Up for Success 279

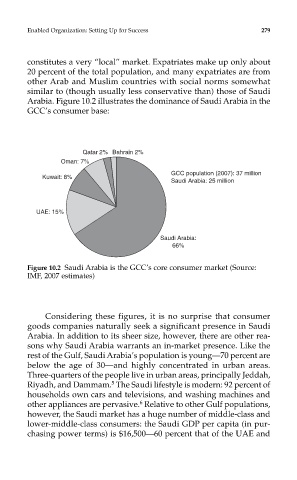

constitutes a very “local” market. Expatriates make up only about

20 percent of the total population, and many expatriates are from

other Arab and Muslim countries with social norms somewhat

similar to (though usually less conservative than) those of Saudi

Arabia. Figure 10.2 illustrates the dominance of Saudi Arabia in the

GCC’s consumer base:

Figure 10.2 Saudi Arabia is the GCC’s core consumer market (Source:

IMF, 2007 estimates)

Considering these figures, it is no surprise that consumer

goods companies naturally seek a significant presence in Saudi

Arabia. In addition to its sheer size, however, there are other rea-

sons why Saudi Arabia warrants an in-market presence. Like the

rest of the Gulf, Saudi Arabia’s population is young—70 percent are

below the age of 30—and highly concentrated in urban areas.

Three-quarters of the people live in urban areas, principally Jeddah,

5

Riyadh, and Dammam. The Saudi lifestyle is modern: 92 percent of

households own cars and televisions, and washing machines and

6

other appliances are pervasive. Relative to other Gulf populations,

however, the Saudi market has a huge number of middle-class and

lower-middle-class consumers: the Saudi GDP per capita (in pur-

chasing power terms) is $16,500—60 percent that of the UAE and