Page 89 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 89

Here to Stay: GCC Market Attractiveness and Risks 73

expected to grow sixfold between 2005 and 2010, to almost 2 million

19

individuals. While this segment has long been the target of private

banking and other financial services, it is now also the target of a

growing array of “elite” products and services across a wide range

of sectors. Ultraluxury hotels, like the $1.1 billion Emirates Palace

Hotel in Abu Dhabi, have suites costing thousands of dollars each

night largely to appeal to intra-GCC elite travelers.

Ongoing Regulatory Reform

To many outsiders, GCC markets appear opaque and shrouded in

mystery. These perceptions are likely the result of a dose of exoticism

fueled by the entertainment and news media. GCC markets do have

a long way to go before they are fully liberalized, but even today they

are quite open by emerging-market standards. GCC leaders have

committed (at least in principle) to continuing the economic reform

process, recognizing that opening up their markets is a critical factor in

their economies’ long-term success. This deregulation process—which

includes encouraging international trade, privatizing state-owned

enterprises, expanding property rights for foreigners, among other

reforms—is the crucial third element in the Opportunity Formula.

The Heritage Foundation, a US think tank, publishes an “Index

of Economic Freedom” each year, scoring countries around the

world and assigning a “Freedom Percentage.” The results of its 2007

Index, some of which are listed in Table 3.1, may be surprising. 20

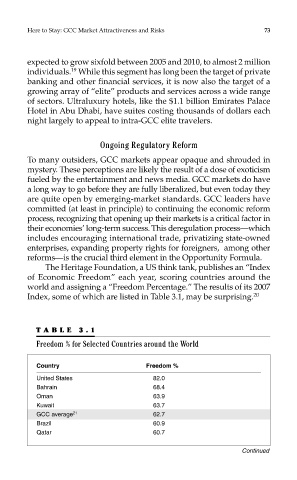

TABLE 3.1

Freedom % for Selected Countries around the World

Country Freedom %

United States 82.0

Bahrain 68.4

Oman 63.9

Kuwait 63.7

GCC average 21 62.7

Brazil 60.9

Qatar 60.7

Continued