Page 102 - E-Bussiness and E-Commerce Management Strategy, Implementation, and Practice

P. 102

M02_CHAF9601_04_SE_C02.QXD:D01_CHAF7409_04_SE_C01.QXD 16/4/09 11:07 Page 69

Chapter 2 E-commerce fundamentals 69

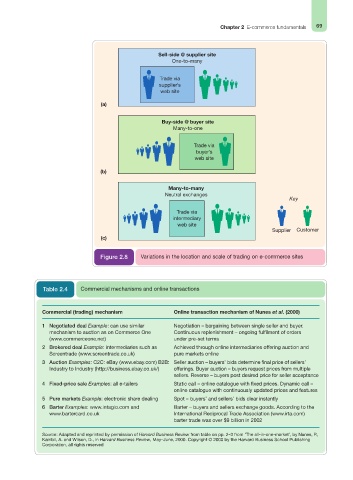

Sell-side @ supplier site

One-to-many

Trade via

supplier’s

web site

(a)

Buy-side @ buyer site

Many-to-one

Trade via

buyer’s

web site

(b)

Many-to-many

Neutral exchanges

Key

Trade via

intermediary

web site

Supplier Customer

(c)

Figure 2.8 Variations in the location and scale of trading on e-commerce sites

Table 2.4 Commercial mechanisms and online transactions

Commercial (trading) mechanism Online transaction mechanism of Nunes et al. (2000)

1 Negotiated deal Example: can use similar Negotiation – bargaining between single seller and buyer.

mechanism to auction as on Commerce One Continuous replenishment – ongoing fulfilment of orders

(www.commerceone.net) under pre-set terms

2 Brokered deal Example: intermediaries such as Achieved through online intermediaries offering auction and

Screentrade (www.screentrade.co.uk) pure markets online

3 Auction Examples: C2C: eBay (www.ebay.com) B2B: Seller auction – buyers’ bids determine final price of sellers’

Industry to Industry (http://business.ebay.co.uk/) offerings. Buyer auction – buyers request prices from multiple

sellers. Reverse – buyers post desired price for seller acceptance

4 Fixed-price sale Examples: all e-tailers Static call – online catalogue with fixed prices. Dynamic call –

online catalogue with continuously updated prices and features

5 Pure markets Example: electronic share dealing Spot – buyers’ and sellers’ bids clear instantly

6 Barter Examples: www.intagio.com and Barter – buyers and sellers exchange goods. According to the

www.bartercard.co.uk International Reciprocal Trade Association (www.irta.com)

barter trade was over $9 billion in 2002

Source: Adapted and reprinted by permission of Harvard Business Review from table on pp. 2–3 from ‘The all-in-one-market’, by Nunes, P.,

Kambil, A. and Wilson, D., in Harvard Business Review, May–June, 2000. Copyright © 2000 by the Harvard Business School Publishing

Corporation, all rights reserved