Page 99 - E-Bussiness and E-Commerce Management Strategy, Implementation, and Practice

P. 99

M02_CHAF9601_04_SE_C02.QXD:D01_CHAF7409_04_SE_C01.QXD 16/4/09 11:07 Page 66

66 Part 1 Introduction

Company Customer

Intermediary

(a)

Disintermediation

Company Customer

(b)

Company Customer

Intermediary

(c)

Reintermediation

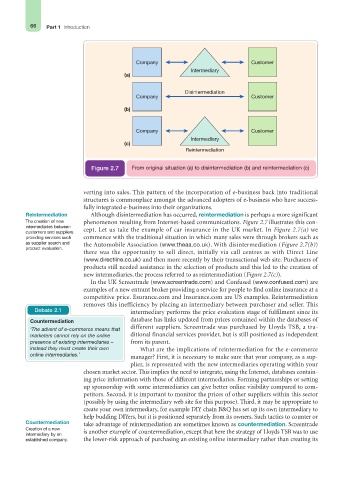

Figure 2.7 From original situation (a) to disintermediation (b) and reintermediation (c)

verting into sales. This pattern of the incorporation of e-business back into traditional

structures is commonplace amongst the advanced adopters of e-business who have success-

fully integrated e-business into their organizations.

Reintermediation Although disintermediation has occurred, reintermediation is perhaps a more significant

The creation of new phenomenon resulting from Internet-based communications. Figure 2.7 illustrates this con-

intermediaries between

customers and suppliers cept. Let us take the example of car insurance in the UK market. In Figure 2.7(a) we

providing services such commence with the traditional situation in which many sales were through brokers such as

as supplier search and the Automobile Association (www.theaa.co.uk). With disintermediation (Figure 2.7(b))

product evaluation.

there was the opportunity to sell direct, initially via call centres as with Direct Line

(www.directline.co.uk) and then more recently by their transactional web site. Purchasers of

products still needed assistance in the selection of products and this led to the creation of

new intermediaries, the process referred to as reintermediation (Figure 2.7(c)).

In the UK Screentrade (www.screentrade.com) and Confused (www.confused.com) are

examples of a new entrant broker providing a service for people to find online insurance at a

competitive price. Esurance.com and Insurance.com are US examples. Reintermediation

removes this inefficiency by placing an intermediary between purchaser and seller. This

Debate 2.1 intermediary performs the price evaluation stage of fulfilment since its

database has links updated from prices contained within the databases of

Countermediation

different suppliers. Screentrade was purchased by Lloyds TSB, a tra-

‘The advent of e-commerce means that

marketers cannot rely on the online ditional financial services provider, but is still positioned as independent

presence of existing intermediaries – from its parent.

instead they must create their own What are the implications of reintermediation for the e-commerce

online intermediaries.’

manager? First, it is necessary to make sure that your company, as a sup-

plier, is represented with the new intermediaries operating within your

chosen market sector. This implies the need to integrate, using the Internet, databases contain-

ing price information with those of different intermediaries. Forming partnerships or setting

up sponsorship with some intermediaries can give better online visibility compared to com-

petitors. Second, it is important to monitor the prices of other suppliers within this sector

(possibly by using the intermediary web site for this purpose). Third, it may be appropriate to

create your own intermediary, for example DIY chain B&Q has set up its own intermediary to

help budding DIYers, but it is positioned separately from its owners. Such tactics to counter or

Countermediation take advantage of reintermediation are sometimes known as countermediation. Screentrade

Creation of a new

intermediary by an is another example of countermediation, except that here the strategy of Lloyds TSB was to use

established company. the lower-risk approach of purchasing an existing online intermediary rather than creating its