Page 143 - Essentials of Payroll: Management and Accounting

P. 143

ESSENTIALS of Payr oll: Management and Accounting

do not usually contribute their tip income back to the employer so taxes

can be withheld from it. If, by the tenth day of the following month

there are insufficient employee funds from which to withhold the des-

ignated amount of taxes, the employer no longer has to collect it. If

there are some employee funds on hand but not enough to cover all

taxes to be withheld, then the withholdings should be first for Social

Security and Medicare on all regular wages, then for federal income

taxes on regular wages, next for Social Security and Medicare taxes on

tips, and finally on income taxes for tips. Also, if the employer does not

have enough reportable wages for an employee to withhold the full

amount of required taxes, the employer must still provide the full

amount of matching taxes.

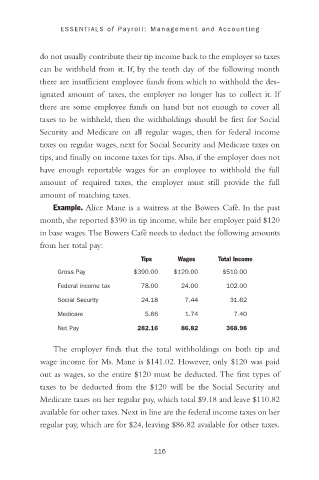

Example. Alice Mane is a waitress at the Bowers Café. In the past

month, she reported $390 in tip income, while her employer paid $120

in base wages.The Bowers Café needs to deduct the following amounts

from her total pay:

Tips Wages Total Income

Gross Pay $390.00 $120.00 $510.00

Federal income tax 78.00 24.00 102.00

Social Security 24.18 7.44 31.62

Medicare 5.66 1.74 7.40

Net Pay 282.16 86.82 368.98

The employer finds that the total withholdings on both tip and

wage income for Ms. Mane is $141.02. However, only $120 was paid

out as wages, so the entire $120 must be deducted. The first types of

taxes to be deducted from the $120 will be the Social Security and

Medicare taxes on her regular pay, which total $9.18 and leave $110.82

available for other taxes.Next in line are the federal income taxes on her

regular pay, which are for $24, leaving $86.82 available for other taxes.

116